Tesla Q2 2025 Earnings: The Good, the Bad, and The Ugly Question

- Sia Gholami

- /

- Jul 27, 2025

The Good:

Tesla posted total revenue of $22.5 billion in Q2 2025, down 12% year-over-year, narrowly missing forecasts. Still, automotive gross margin stabilized, improving slightly from 16.3% in Q1 to approximately 16.4% in Q2. Non-GAAP EPS came in around $0.40, matching consensus and down roughly 23%, while GAAP EPS of $0.33 represented an 18% decline YoY. Tesla reported free cash flow of $100M, a steep drop from the prior year, yet still positive for the period. Notwithstanding the headwinds, Elon Musk reiterated confidence in Tesla’s emerging autonomy initiatives, including robotaxi pilots, Optimus humanoid robots, and expanded FSD adoption.

The Bad:

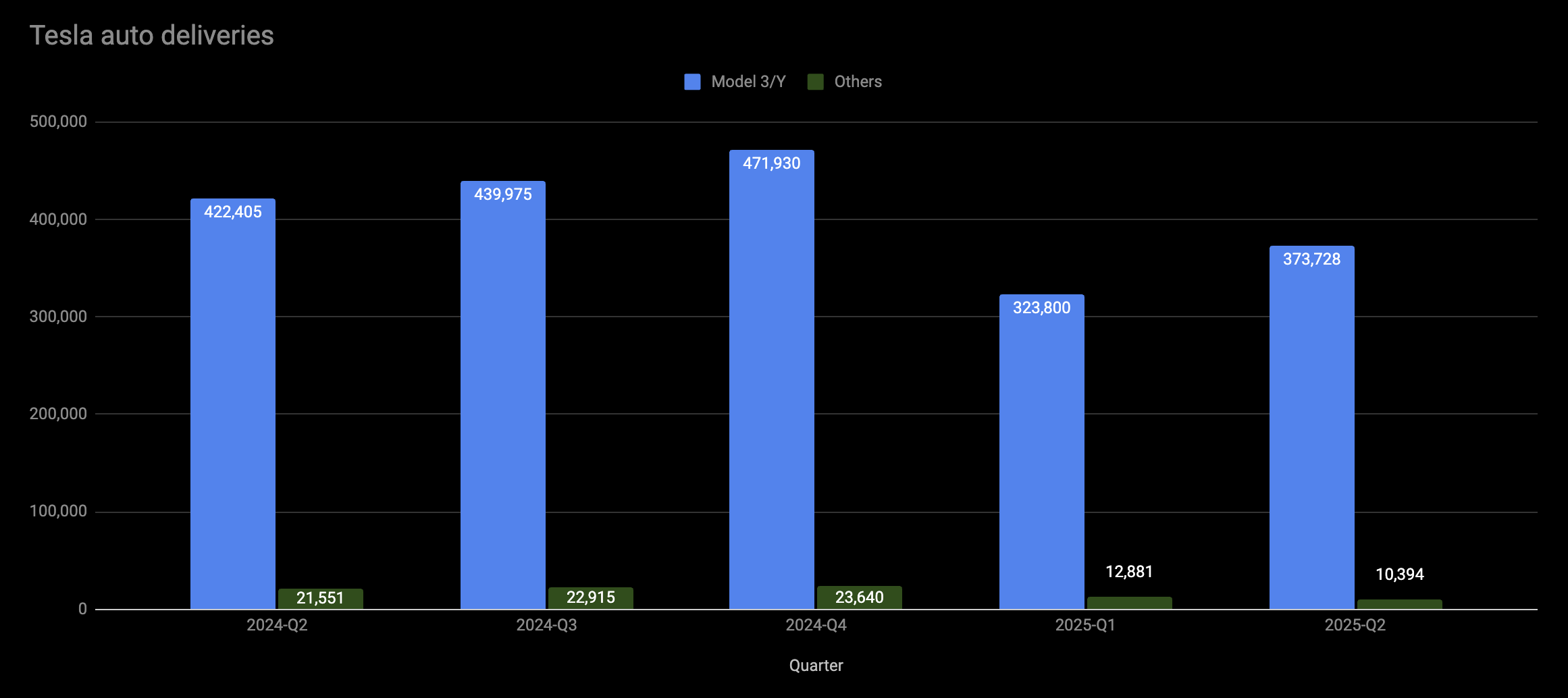

Vehicle deliveries fell to 384,122 units, down about 14% from Q2 2024, and automotive revenue dropped 16.6% YoY, to roughly $16.6B. Energy generation and storage revenues declined approximately 7% to $2.8B. Regulatory credit revenue slumped nearly 51%, contributing just about $439M, further compressing ASPs in key markets such as China and Europe. Pricing pressure intensified in response to slowing demand. Tesla did not reaffirm FY25 delivery guidance, raising concerns over softer volume amidst increased dilution from share-based compensation and no announced share repurchases. Model Y sales declined sharply, with Kelley Blue Book estimating a 15% drop in U.S. Q2 2025, and it has been dethroned as the world’s best-selling vehicle—Toyota RAV4 reclaimed the top title in 2024 by a narrow margin.

The Ugly Question:

Is Tesla genuinely pivoting from being an electric vehicle company to an AI-first firm—or is this strategic shift overshadowing deteriorating core fundamentals? The earnings call highlighted robotaxi expansions (including a limited launch in San Francisco with safety drivers), Dojo supercomputing progress, plans for Optimus robot launches in 2026, and an anticipated lower-cost EV model in late 2025. Elon Musk emphasized autonomy as the long-term value driver, yet Tesla lacks current evidence of autonomous systems generating sustainable, high-margin recurring revenue. With mounting competition and thinning margins, the key question remains: can Tesla legitimately become a leading AI and autonomy company, or is the narrative a distraction designed to justify high valuations amid slipping EV demand?

About The Author

Sia Gholami

Sia Gholami is a distinguished expert in the intersection of

artificial intelligence and finance. He holds a bachelor's, master's, and Ph.D. in computer

science, with his doctoral thesis focused on efficient large language models and their

applications—an area crucial to the development of advanced AI systems. Specializing in machine

learning and artificial intelligence, Sia has authored several research papers published in

peer-reviewed venues, establishing his authority in both academic and professional circles.

Sia has created AI models and systems specifically designed to identify opportunities in the

public market, leveraging his expertise to develop cutting-edge financial technologies. His most

recent role was at Amazon, where he worked within Amazon Ads, developing and deploying AI and

machine learning models to production with remarkable success. This experience, combined with

his deep technical knowledge and understanding of financial systems, positions Sia as a leading

figure in AI-driven financial technologies. His extensive background has also led him to found

and lead successful ventures, driving innovation at the convergence of AI and finance.