Block Joins the S&P 500: A Milestone for the Fintech Pioneer

- Sia Gholami

- /

- Jul 20, 2025

On July 23, 2025, Block Inc. (NYSE: XYZ) will officially join the S&P 500, replacing Hess Corp. (HES) in the widely followed U.S. equity index. The announcement, made by S&P Dow Jones Indices on July 18, marks a significant milestone for the fintech company, which has evolved far beyond its original point-of-sale hardware roots into a diversified digital finance platform. The move will become effective prior to the market open on Wednesday, bringing Block into the portfolios of countless institutional and index-linked investors.

Block's inclusion in the S&P 500 underscores the market’s growing recognition of fintech as a core component of the modern economy. To qualify for the index, companies must meet strict criteria including sustained profitability, strong liquidity, and a significant U.S. presence. Block has cleared these hurdles, supported by a market capitalization of approximately $43 billion and a business model centered on its Square merchant ecosystem, Cash App’s expanding financial services, and strategic bets on digital assets and decentralized technologies. This development also reflects a broader trend of crypto-adjacent and platform-based financial companies gaining mainstream status; Coinbase, for example, was added to the index in May 2025.

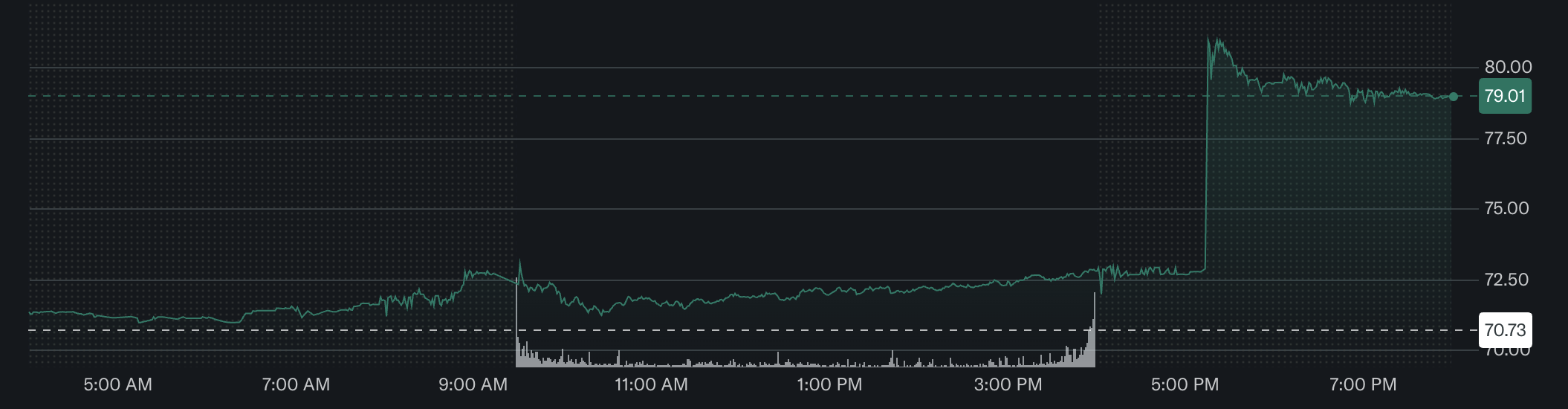

Investors responded immediately to the announcement, with Block shares rising 9–11 percent in after-hours trading on July 18. This rally reflects both the technical impact of forced buying from passive index funds and the broader investor sentiment that inclusion confers long-term legitimacy and financial maturity. The shift is expected to generate several billion dollars in net inflows to the stock as ETFs and institutional managers rebalance to reflect the updated index composition.

Block’s product ecosystem spans multiple categories of financial services. Square provides point-of-sale hardware and software, business loans, invoicing, and team management tools for millions of small and mid-sized businesses. Cash App, its consumer-facing platform, functions as a mobile banking alternative, offering peer-to-peer payments, direct deposit, investing in stocks and Bitcoin, a debit card, and tax filing. Afterpay extends Block’s reach into buy-now-pay-later services across global e-commerce and retail partners. This integration of merchant services, consumer banking, and crypto infrastructure positions Block as one of the most comprehensive financial platforms in the U.S. market.

Ultimately, Block’s inclusion in the S&P 500 reflects its transition from disruptor to core financial infrastructure. While execution risks remain—especially around profitability in newer segments—the company’s operational scale, diverse product portfolio, and consistent growth make it emblematic of the digital financial future increasingly embedded in the broader market.

About The Author

Sia Gholami

Sia Gholami is a distinguished expert in the intersection of

artificial intelligence and finance. He holds a bachelor's, master's, and Ph.D. in computer

science, with his doctoral thesis focused on efficient large language models and their

applications—an area crucial to the development of advanced AI systems. Specializing in machine

learning and artificial intelligence, Sia has authored several research papers published in

peer-reviewed venues, establishing his authority in both academic and professional circles.

Sia has created AI models and systems specifically designed to identify opportunities in the

public market, leveraging his expertise to develop cutting-edge financial technologies. His most

recent role was at Amazon, where he worked within Amazon Ads, developing and deploying AI and

machine learning models to production with remarkable success. This experience, combined with

his deep technical knowledge and understanding of financial systems, positions Sia as a leading

figure in AI-driven financial technologies. His extensive background has also led him to found

and lead successful ventures, driving innovation at the convergence of AI and finance.