Robinhood Tokenizes Stocks: Tokenized U.S. Equities to Launch in EU as Platform Expands Blockchain Ambitions

- Sia Gholami

- /

- Jul 13, 2025

Robinhood is a commission-free trading platform that revolutionized retail investing in the United States by making stock and options trading accessible through an easy-to-use mobile app. Since its launch in 2013, the company has grown rapidly, attracting millions of younger investors with its zero-commission model, slick interface, and focus on financial democratization. In addition to equities and ETFs, Robinhood also supports cryptocurrency trading, further expanding its reach among tech-savvy retail users.

In a bold step toward global expansion and blockchain integration, Robinhood recently announced plans to tokenize U.S. stocks into crypto assets via a new platform called Robinhood Crypto in Europe. This will allow European users to trade blockchain-based versions of U.S. equities 24/7, in fractional amounts, without traditional market hours or intermediaries. These tokenized stocks will be backed 1:1 by real shares held in custody, and trades will settle instantly on-chain. This initiative is positioned as a key differentiator in Robinhood’s European strategy and leverages recent acquisitions and product development in the blockchain space.

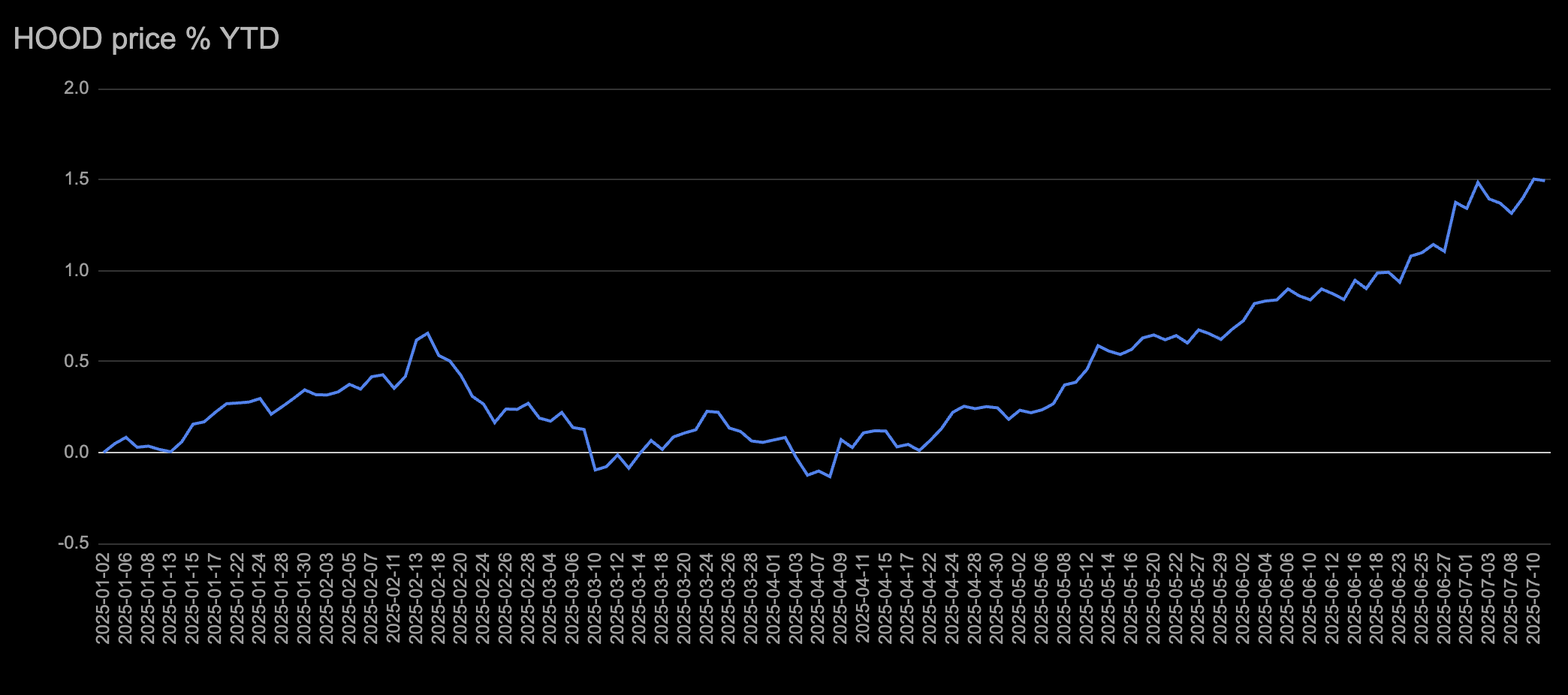

Following the announcement, Robinhood's stock (HOOD) saw a notable uptick. The market responded positively to the innovation and global growth narrative, viewing it as a long-term catalyst for revenue diversification and product differentiation. The stock rose nearly 6% in intraday trading after the news broke, outperforming broader indices and signaling investor optimism about Robinhood's ability to evolve beyond its U.S. trading roots. Volume also spiked, reflecting renewed interest from both retail and institutional holders.

Despite the enthusiasm, the move introduces a mix of regulatory and operational risks. Tokenized securities operate in a complex legal environment, especially as global regulators increase scrutiny on crypto-based financial products. Robinhood will need to navigate jurisdiction-specific compliance challenges, anti-money laundering safeguards, and potential resistance from traditional exchanges. On the opportunity side, tokenization could unlock a new generation of 24/7 trading, reduce friction in cross-border asset access, and attract crypto-native users looking to diversify into traditional assets—all under a single digital-first platform.

Robinhood’s expansion into tokenized equities marks a strategic pivot toward global, crypto-integrated finance. While the risks are significant, particularly around regulation and execution, the upside could be transformational if the company succeeds in bridging traditional and decentralized markets. For investors, the move signals a company willing to push boundaries, and for European users, it could mean early access to a new form of frictionless, blockchain-based equity investing.

About The Author

Sia Gholami

Sia Gholami is a distinguished expert in the intersection of

artificial intelligence and finance. He holds a bachelor's, master's, and Ph.D. in computer

science, with his doctoral thesis focused on efficient large language models and their

applications—an area crucial to the development of advanced AI systems. Specializing in machine

learning and artificial intelligence, Sia has authored several research papers published in

peer-reviewed venues, establishing his authority in both academic and professional circles.

Sia has created AI models and systems specifically designed to identify opportunities in the

public market, leveraging his expertise to develop cutting-edge financial technologies. His most

recent role was at Amazon, where he worked within Amazon Ads, developing and deploying AI and

machine learning models to production with remarkable success. This experience, combined with

his deep technical knowledge and understanding of financial systems, positions Sia as a leading

figure in AI-driven financial technologies. His extensive background has also led him to found

and lead successful ventures, driving innovation at the convergence of AI and finance.