The Big Beautiful Bill: A Fiscal Shock With Market Momentum

- Sia Gholami

- /

- Jul 6, 2025

The recently passed “Big Beautiful Bill” (BBB), a sweeping $3.3 trillion fiscal package, has triggered a decisive rally in U.S. equity markets. The S&P 500 and Nasdaq reached new record highs in the days following the bill’s approval, driven by a sharp repricing of growth expectations. At its core, the bill unlocks large-scale funding across domestic manufacturing, infrastructure, clean energy, and advanced technology—effectively functioning as a coordinated industrial policy with near-term macroeconomic consequences.

The equity market's reaction reflects a broad-based risk-on shift. Technology leaders, particularly in AI and semiconductors, extended gains with Nvidia nearing a $4 trillion market cap. The rally was not confined to large-cap tech: cyclicals, industrials, and small-cap equities also rebounded, as investors rotated into U.S.-centric growth exposures. One of the bill’s immediate effects was to ease trade-related concerns. Though the original tariff moratorium was set to expire on July 9, the Treasury confirmed that the operative deadline for trade compliance is August 1. This reduced tail risk for multinational firms and provided short-term relief across global sectors exposed to potential retaliatory measures.

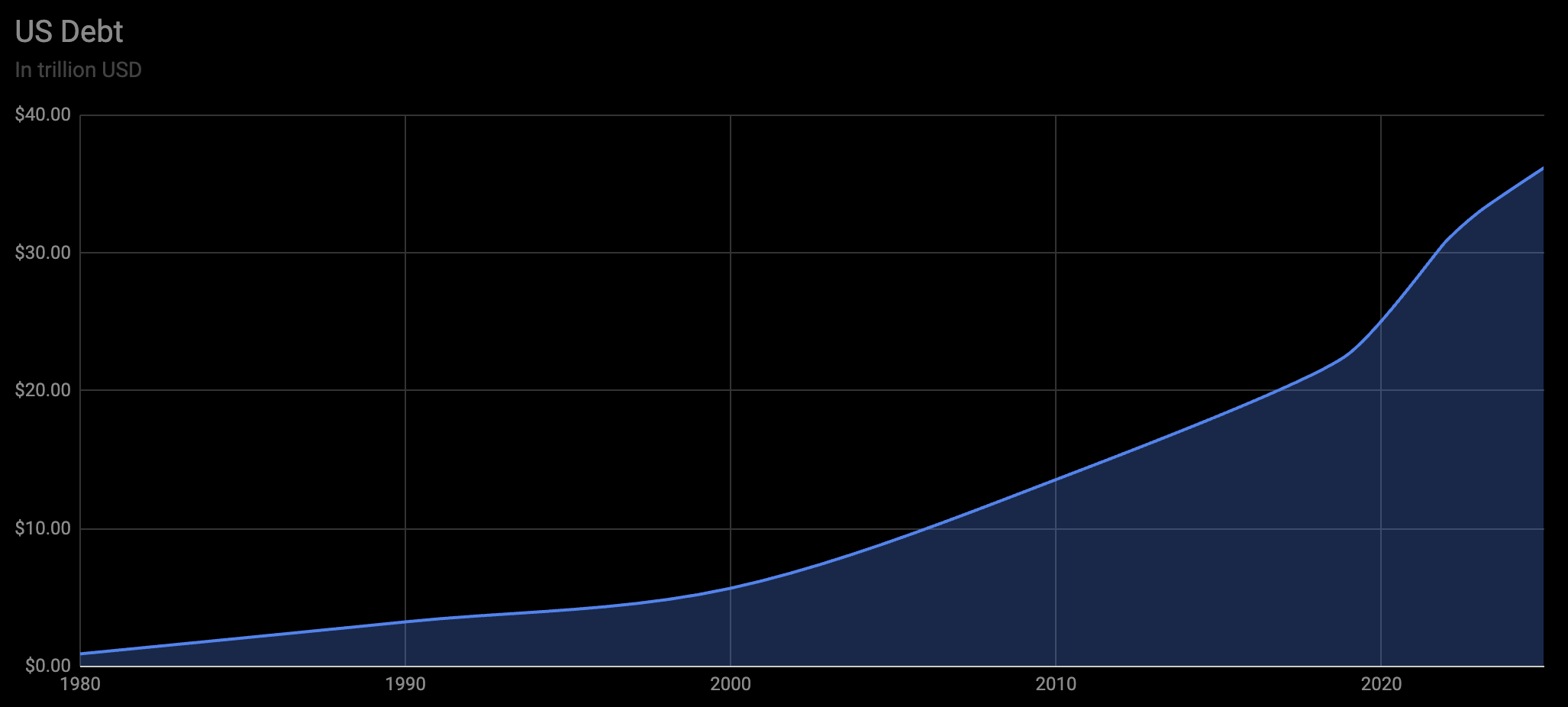

In the near term, the policy combination of fiscal stimulus and deferred trade penalties is clearly supportive of risk assets. The capital directed toward AI infrastructure, clean energy deployment, and semiconductor manufacturing is likely to reinforce secular investment themes and support earnings in capital-intensive sectors. However, the structural consequences of the bill are less favorable. The legislation increases the projected U.S. debt burden substantially, with debt-to-GDP ratios expected to breach 130% in the next decade. Treasury issuance is set to rise, and long-end yields have already moved higher in anticipation of increased supply and persistent inflationary pressure.

From a monetary policy perspective, the bill complicates the Federal Reserve’s path forward. While softening labor data had opened the door for rate cuts, the scale of fiscal expansion reduces the Fed’s room to ease without risking a policy mismatch. With financial conditions easing and risk assets rallying, the likelihood of near-term rate cuts has diminished, even as real interest rates remain elevated.

The bill also introduces a binary risk structure around the August 1 tariff enforcement deadline. If key trade partners fail to strike new bilateral agreements in time, tariffs of up to 70% could be imposed, with highly asymmetric downside risk for affected sectors. As such, the current rally is contingent on successful execution of both the bill’s investment agenda and its trade diplomacy framework.

The BBB exemplifies a bifurcated environment: on one hand, it introduces short-term alpha potential for sectors aligned with national priorities; on the other, it amplifies fragility around debt sustainability, interest rates, and geopolitical tensions. Investors should closely monitor bond market behavior, real yield shifts, and the negotiation outcomes ahead of August. While the policy shift is growth-supportive today, the underlying financial architecture faces new constraints that will reassert themselves over the medium term.

About The Author

Sia Gholami

Sia Gholami is a distinguished expert in the intersection of

artificial intelligence and finance. He holds a bachelor's, master's, and Ph.D. in computer

science, with his doctoral thesis focused on efficient large language models and their

applications—an area crucial to the development of advanced AI systems. Specializing in machine

learning and artificial intelligence, Sia has authored several research papers published in

peer-reviewed venues, establishing his authority in both academic and professional circles.

Sia has created AI models and systems specifically designed to identify opportunities in the

public market, leveraging his expertise to develop cutting-edge financial technologies. His most

recent role was at Amazon, where he worked within Amazon Ads, developing and deploying AI and

machine learning models to production with remarkable success. This experience, combined with

his deep technical knowledge and understanding of financial systems, positions Sia as a leading

figure in AI-driven financial technologies. His extensive background has also led him to found

and lead successful ventures, driving innovation at the convergence of AI and finance.