Carnival Cruises Surges on Record Bookings and Raised Guidance: A Deep Dive into the Q2 2025 Earnings

- Sia Gholami

- /

- Jun 29, 2025

Carnival Corporation (NYSE: CCL) is the world’s largest cruise line company, operating a portfolio of nine cruise brands including Carnival Cruise Line, Princess Cruises, Holland America Line, and Cunard. With a global fleet of over 90 ships, the company serves millions of passengers annually across North America, Europe, Australia, and Asia. Carnival’s business model revolves around delivering all-inclusive vacation experiences at sea, combining transportation, lodging, entertainment, and food services into a single product. The company benefits from both economies of scale and brand segmentation, targeting a broad range of income brackets and travel preferences.

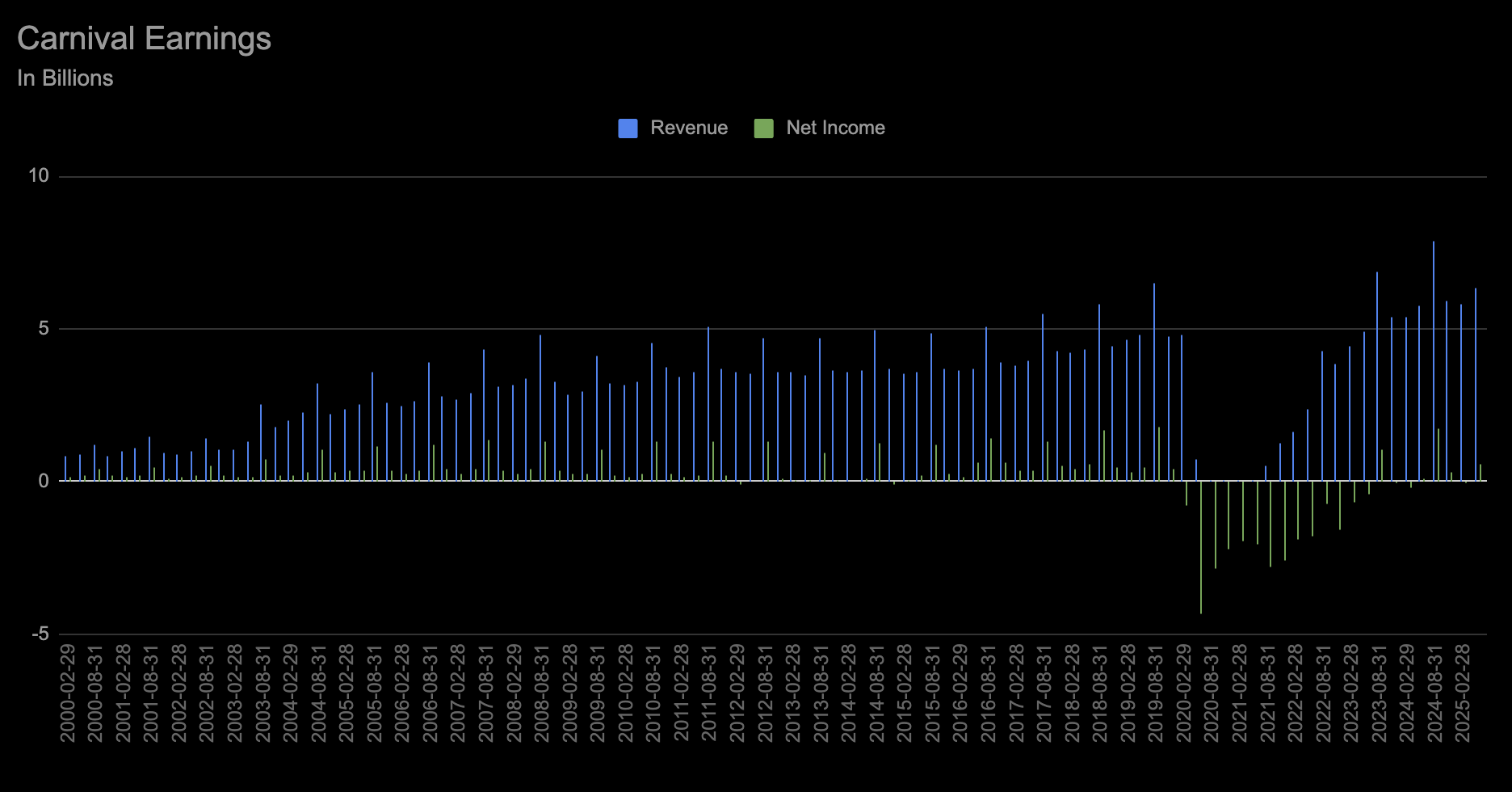

On June 24, 2025, Carnival reported its fiscal Q2 results that significantly outperformed expectations. The company posted adjusted earnings per share of $0.35, well ahead of the $0.24 consensus estimate. Revenue reached $6.33 billion, representing a 9.5% year-over-year increase, and the company raised its full-year adjusted EBITDA guidance to $6.9 billion, citing record-setting booking volumes and strong onboard spending trends. Pricing on future sailings also improved, contributing to higher yield expectations across the fleet.

This earnings report stood out because it reflects a broader consumer shift from goods to experiences. As discretionary spending habits evolve, many consumers—especially millennials and Gen Z—are prioritizing travel, leisure, and shared experiences over physical possessions. Carnival is a direct beneficiary of this trend. The company has also successfully launched new marketing initiatives and loyalty programs, and its investment in upgrading the fleet with newer, more fuel-efficient ships is driving both cost discipline and customer satisfaction. In short, strong demand, disciplined operations, and effective pricing power have converged to produce a standout quarter.

However, risks remain. While booking trends are robust, the cruise industry is still sensitive to macroeconomic variables such as fuel prices, interest rates, and geopolitical tensions. Carnival also continues to carry a heavy debt load from the pandemic period, which could weigh on future cash flow flexibility. Additionally, the company faces growing regulatory and reputational risks from environmental concerns. Overtourism backlash in key ports and tightening emissions standards may lead to costlier compliance requirements and operational restrictions, especially in regions such as the Mediterranean and Alaska.

Despite these concerns, Carnival’s Q2 performance signals strong execution and tailwinds from a structurally favorable shift in consumer behavior. If the company can maintain yield discipline and gradually deleverage its balance sheet while capitalizing on experiential travel demand, it is well-positioned to outperform in the leisure sector. The earnings beat and raised guidance underscore a business regaining its footing and expanding its moat at a time when many discretionary peers are seeing contraction.

About The Author

Sia Gholami

Sia Gholami is a distinguished expert in the intersection of

artificial intelligence and finance. He holds a bachelor's, master's, and Ph.D. in computer

science, with his doctoral thesis focused on efficient large language models and their

applications—an area crucial to the development of advanced AI systems. Specializing in machine

learning and artificial intelligence, Sia has authored several research papers published in

peer-reviewed venues, establishing his authority in both academic and professional circles.

Sia has created AI models and systems specifically designed to identify opportunities in the

public market, leveraging his expertise to develop cutting-edge financial technologies. His most

recent role was at Amazon, where he worked within Amazon Ads, developing and deploying AI and

machine learning models to production with remarkable success. This experience, combined with

his deep technical knowledge and understanding of financial systems, positions Sia as a leading

figure in AI-driven financial technologies. His extensive background has also led him to found

and lead successful ventures, driving innovation at the convergence of AI and finance.