Oracle’s Q4 FY25 Earnings Report: AI Tailwinds Amid Cloud Competition

- Sia Gholami

- /

- Jun 15, 2025

Oracle Corporation is a global technology company best known for its enterprise database software, cloud infrastructure, and enterprise applications. Historically dominant in on-premises database management systems, Oracle has spent the last decade aggressively shifting toward cloud-based solutions. Its offerings include Oracle Cloud Infrastructure (OCI), a direct competitor to Amazon Web Services and Microsoft Azure, as well as Fusion and NetSuite, two widely used SaaS platforms for ERP, HCM, and financial management. With growing emphasis on AI integration, Oracle has been positioning itself as both a foundational data layer and a cloud compute provider for enterprise AI workloads.

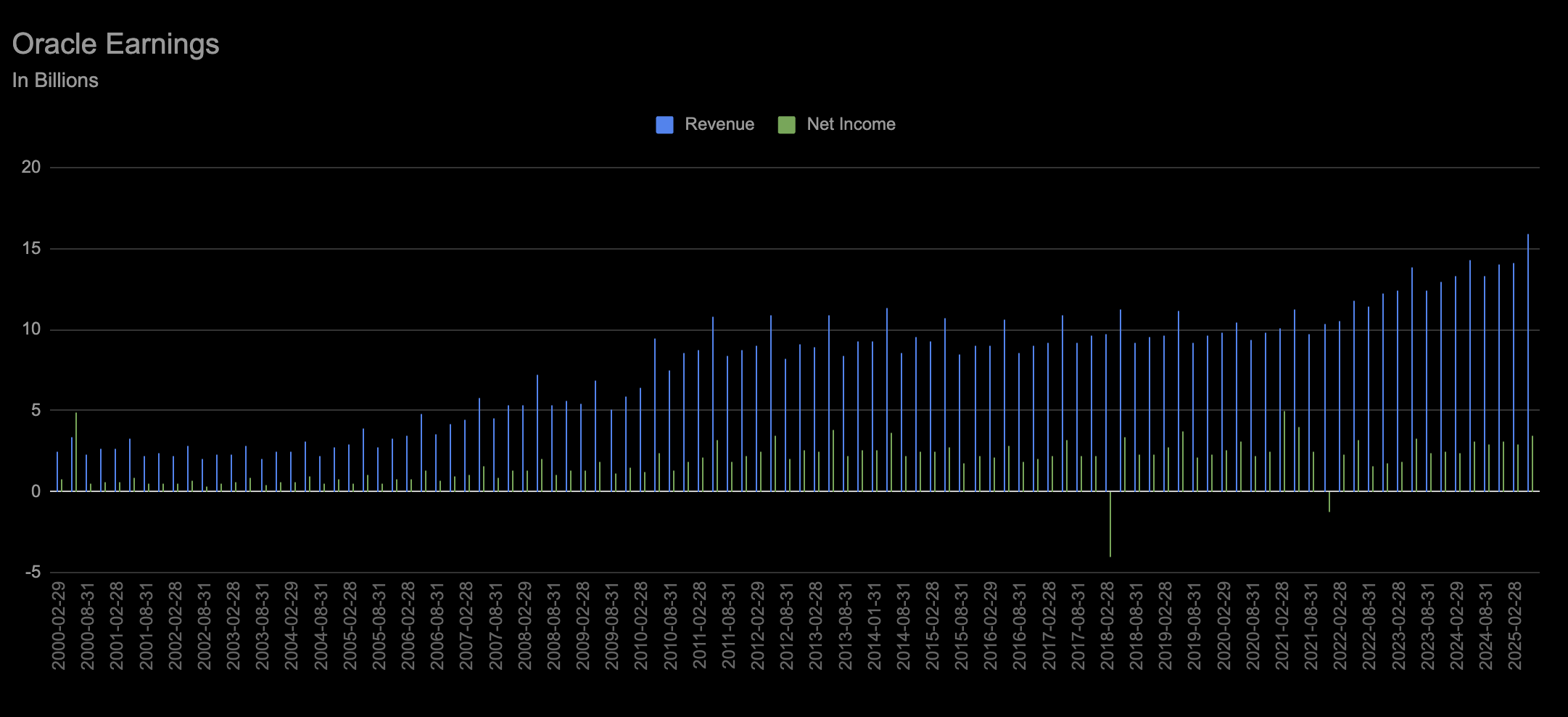

In its most recent earnings report for the fourth fiscal quarter of 2025, Oracle posted mixed results. Revenue grew 3% year-over-year to $14.3 billion, slightly below analyst expectations. Cloud services and license support, the largest segment, rose 9% to $10.2 billion. However, cloud infrastructure revenue—seen as a critical growth engine—came in at $2.0 billion, a 42% year-over-year increase, which is strong but slightly below the previous quarter’s pace. EPS was $1.63 (non-GAAP), missing Wall Street consensus by a few cents. The market responded negatively, with Oracle shares falling post-earnings.

Several factors contributed to the uneven results. First, the strong cloud infrastructure growth, while impressive, showed signs of deceleration, likely due to intense competition from AWS, Azure, and Google Cloud. Second, legacy software segments such as on-premise license revenue declined, creating a drag on overall performance. Third, while Oracle has secured high-profile AI partnerships—including with OpenAI and NVIDIA—the monetization of those relationships appears to be in early stages. Capex and data center buildouts are also ramping, compressing margins in the near term. Furthermore, customer transitions to Oracle Cloud continue to be complex and multi-year in nature, especially for large enterprise clients.

Despite its strategic pivot, Oracle faces key risks. The cloud infrastructure market is highly competitive and capital-intensive, with hyperscalers benefiting from deeper developer ecosystems and greater market penetration. Oracle’s late entry has narrowed its window for significant market share gains. In addition, execution risk remains elevated: any delays in cloud migrations or AI workload ramp-up could dampen near-term investor expectations. Currency fluctuations and macroeconomic headwinds also weigh on multinational enterprise IT spending.

Oracle continues to evolve from a legacy enterprise software vendor into a modern cloud and AI infrastructure player. While the recent earnings report showed solid growth in cloud infrastructure and key AI partnerships, results fell short of elevated investor expectations. The long-term opportunity in AI workloads and verticalized SaaS remains intact, but Oracle must accelerate both monetization and adoption while navigating an intensely competitive environment. For investors, this quarter serves as a reminder that the transformation story is ongoing—strategically promising, but tactically complex.

About The Author

Sia Gholami

Sia Gholami is a distinguished expert in the intersection of

artificial intelligence and finance. He holds a bachelor's, master's, and Ph.D. in computer

science, with his doctoral thesis focused on efficient large language models and their

applications—an area crucial to the development of advanced AI systems. Specializing in machine

learning and artificial intelligence, Sia has authored several research papers published in

peer-reviewed venues, establishing his authority in both academic and professional circles.

Sia has created AI models and systems specifically designed to identify opportunities in the

public market, leveraging his expertise to develop cutting-edge financial technologies. His most

recent role was at Amazon, where he worked within Amazon Ads, developing and deploying AI and

machine learning models to production with remarkable success. This experience, combined with

his deep technical knowledge and understanding of financial systems, positions Sia as a leading

figure in AI-driven financial technologies. His extensive background has also led him to found

and lead successful ventures, driving innovation at the convergence of AI and finance.