Broadcom Powers AI Infrastructure: Solid earnings reflect demand for chips behind GPU-driven data centers

- Sia Gholami

- /

- Jun 8, 2025

Broadcom is a leading semiconductor and infrastructure software company, supplying components that power everything from smartphones and networking gear to enterprise data centers. In the artificial intelligence space, Broadcom plays a crucial role in supplying high-performance networking chips and custom ASICs that support large-scale AI workloads. Their offerings include advanced PCIe switches, custom silicon solutions for hyperscalers, and high-speed interconnect technologies that are critical for training and deploying AI models at scale.

Broadcom’s AI-specific portfolio includes chips like the Tomahawk and Trident families of Ethernet switches, the Jericho routing chips, and its Bailly custom AI interconnect solutions. The Tomahawk 5, for example, delivers 51.2 Tbps of bandwidth and is used in next-generation AI and cloud-scale data centers to support high-throughput networking between GPUs. Trident 4 is optimized for AI-edge and enterprise environments that require flexible forwarding and telemetry. Meanwhile, Jericho3-AI is tailored for AI workloads with ultra-low latency and congestion-aware routing, critical for training large-scale AI models. These chips are not AI accelerators themselves, but they are essential infrastructure for interconnecting thousands of NVIDIA GPUs, or equivalent accelerators, in AI supercomputing clusters. Their compatibility with NVIDIA’s NVLink/NVSwitch-based systems or PCIe-based topologies makes them foundational to scalable GPU deployments.

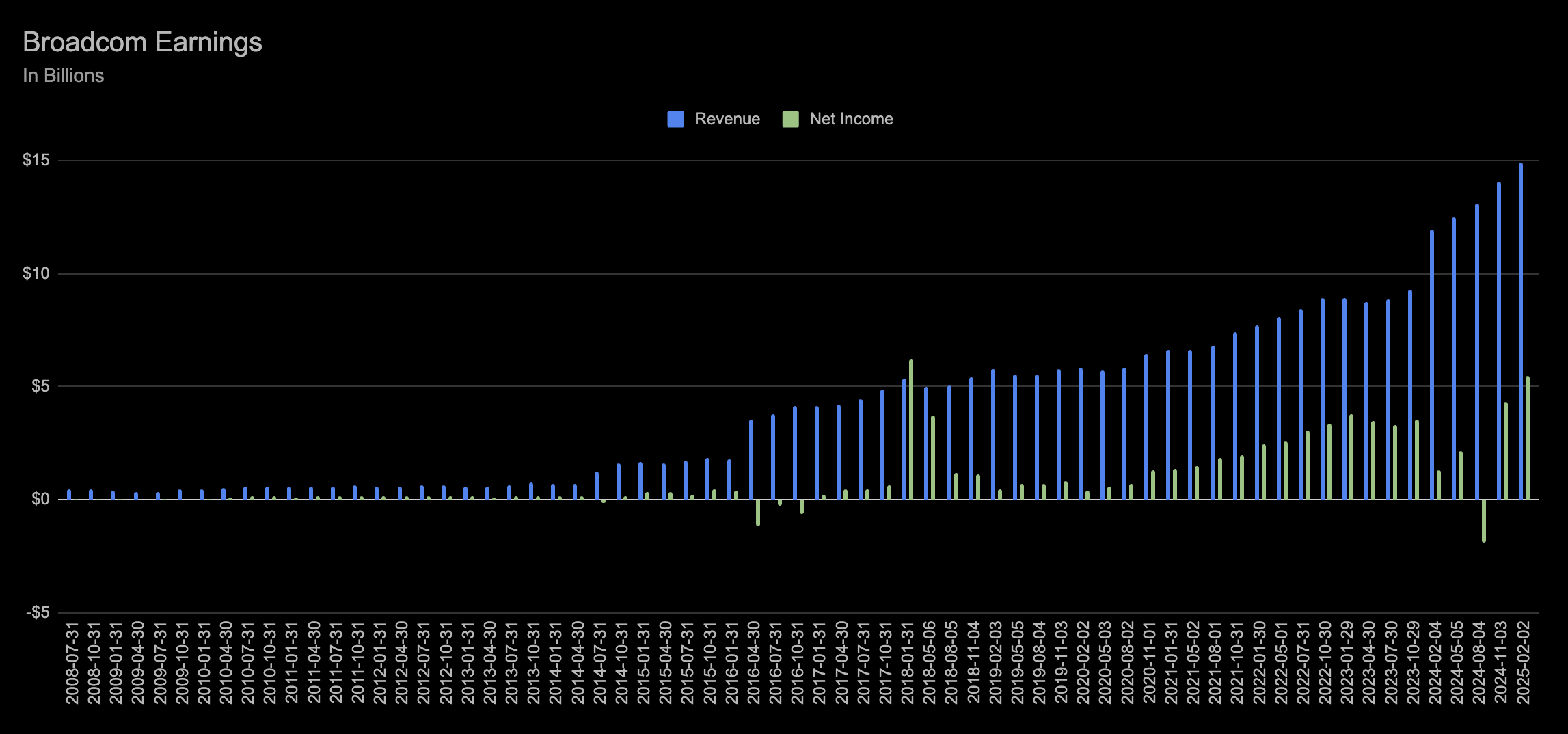

In its latest quarterly earnings report for Q2 FY2025, Broadcom reported revenue of $15.0 billion, slightly above analyst expectations of $14.99 billion. The company also provided guidance for Q3 FY2025, forecasting revenue of $15.8 billion, driven largely by demand in the AI segment. While the beat was modest, it continued Broadcom's streak of delivering steady results in an increasingly competitive semiconductor market.

The reported growth was primarily fueled by AI-related demand, with semiconductor revenue rising 16.7% year-over-year to $8.41 billion. Broadcom’s custom silicon business and networking chips for AI data centers remained key drivers of this performance. Strong customer demand from hyperscalers building out AI infrastructure contributed significantly to the revenue uptick. Additionally, the company’s integration of VMware is expected to provide a long-term software growth vector, although it remains a secondary driver for now.

Despite the positive headline numbers, investor reaction was muted. Shares slipped slightly after the report, suggesting that much of the AI optimism was already priced in. Risks to Broadcom’s outlook include potential overdependence on a small group of large AI infrastructure buyers, ongoing regulatory scrutiny over the VMware acquisition, and broader macroeconomic headwinds affecting enterprise IT budgets. Furthermore, competition from other chipmakers entering the AI infrastructure market may compress margins over time.

Broadcom delivered a solid quarter supported by real momentum in AI-driven demand. However, with expectations already elevated and competitive pressures rising, sustaining its growth trajectory will require more than just incremental AI tailwinds. Investors will be watching closely to see if the company can expand its AI portfolio while maintaining resilience across its broader semiconductor and software businesses.

About The Author

Sia Gholami

Sia Gholami is a distinguished expert in the intersection of

artificial intelligence and finance. He holds a bachelor's, master's, and Ph.D. in computer

science, with his doctoral thesis focused on efficient large language models and their

applications—an area crucial to the development of advanced AI systems. Specializing in machine

learning and artificial intelligence, Sia has authored several research papers published in

peer-reviewed venues, establishing his authority in both academic and professional circles.

Sia has created AI models and systems specifically designed to identify opportunities in the

public market, leveraging his expertise to develop cutting-edge financial technologies. His most

recent role was at Amazon, where he worked within Amazon Ads, developing and deploying AI and

machine learning models to production with remarkable success. This experience, combined with

his deep technical knowledge and understanding of financial systems, positions Sia as a leading

figure in AI-driven financial technologies. His extensive background has also led him to found

and lead successful ventures, driving innovation at the convergence of AI and finance.