CoreWeave’s AI Surge: Nvidia-backed cloud provider posts 420% growth but faces financial pressure amid rapid expansion

- Sia Gholami

- /

- May 18, 2025

CoreWeave, a cloud infrastructure provider specializing in AI workloads, has quickly emerged as one of the most closely watched players in high-performance computing. Founded in 2017 and originally focused on Ethereum mining, the company pivoted to GPU-accelerated infrastructure tailored for artificial intelligence. Today, CoreWeave operates at the heart of the AI boom, delivering compute power to some of the most influential companies in the world.

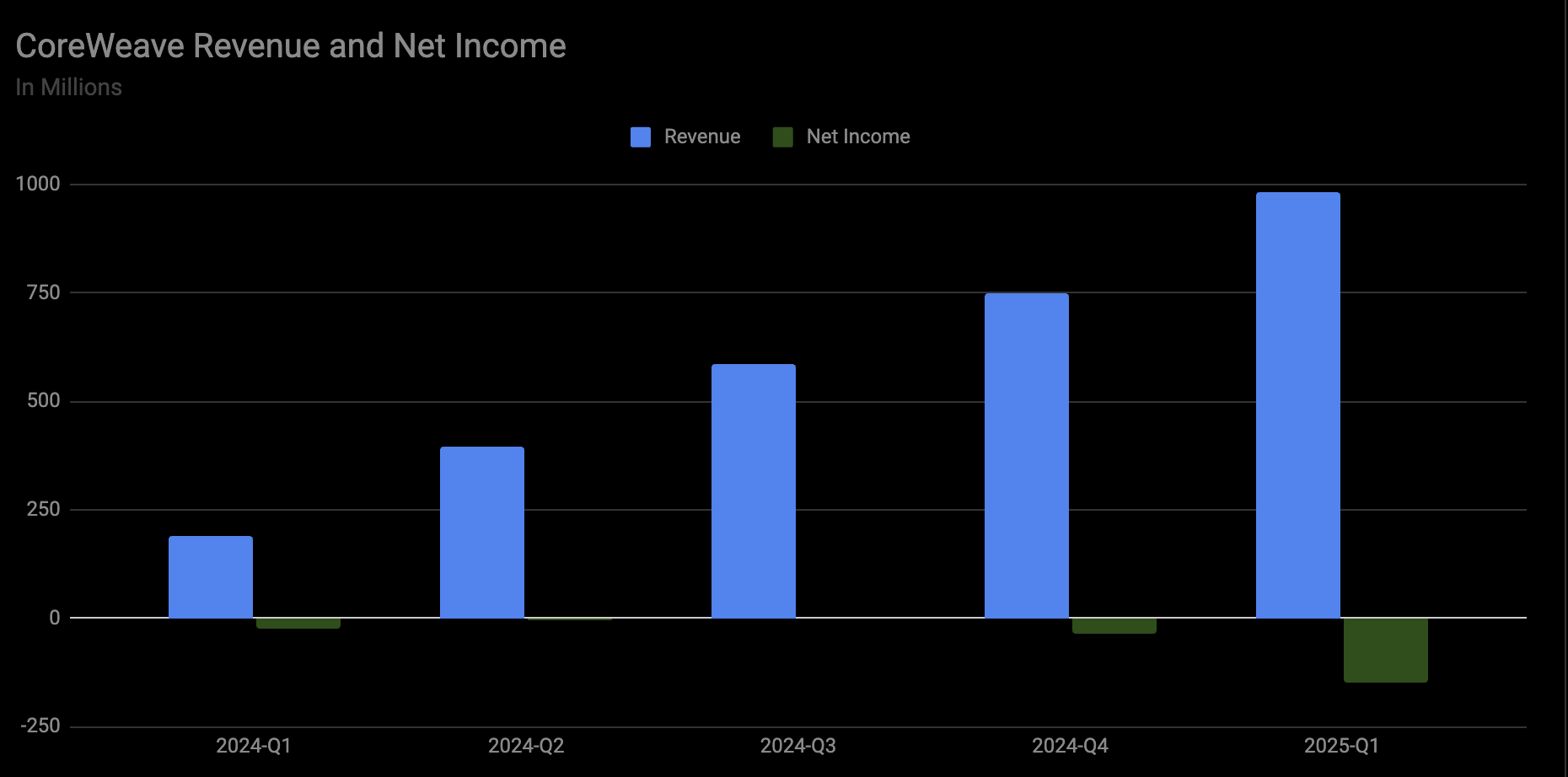

Explosive Q1 2025 Results

In its first earnings report as a public company, CoreWeave posted Q1 2025 revenue of $981.6 million, a 420% year-over-year increase. Adjusted EBITDA was $606.1 million with a 62% margin, and adjusted operating income stood at $162.6 million. The company also revealed a revenue backlog of $25.9 billion, comprising $14.7 billion in remaining performance obligations and $11.2 billion in committed contracts. Despite its scale, CoreWeave posted a net loss of $314.6 million due to aggressive infrastructure spending and stock-based compensation.

Strategic Partnerships Fuel Growth

CoreWeave has locked in strategic multi-year contracts with major AI players. It recently expanded its deal with OpenAI to $4 billion through 2029 and added Google to its customer roster. Microsoft is another major client, and Nvidia holds a 5% equity stake in the company. Nvidia has also designated CoreWeave as its first Elite Cloud Services Provider for compute — a distinction that highlights its unique positioning in the AI ecosystem.

Infrastructure Buildout and Technology Edge

The company is in the midst of a massive infrastructure expansion. In 2025 alone, CoreWeave plans to spend between $20 billion and $23 billion to support demand. It currently operates 33 data centers across the U.S. and Europe, with 420MW of active power and 1.6GW under contract. CoreWeave is also the first to bring NVIDIA GB200 NVL72-based instances to market, offering a new tier of AI performance for next-generation workloads.

A Cautionary Note: Capital Intensity and Financial Risk

Despite its top-line momentum and premier client list, CoreWeave's financial structure raises red flags. Its aggressive capital expenditure strategy has resulted in $12.9 billion in debt, largely secured by over 250,000 Nvidia GPUs. As interest rates remain elevated and infrastructure costs continue to rise, the company faces a narrowing margin for error. Profitability is still elusive, and any slowdown in AI infrastructure demand or execution missteps could materially impact its outlook. Investors should carefully weigh long-term potential against the very real near-term financial strain.

Outlook: Dominance or Overreach?

CoreWeave forecasts full-year 2025 revenue of $4.9 to $5.1 billion. Its unique position at the intersection of AI infrastructure, cutting-edge GPUs, and elite customers like OpenAI and Google gives it significant strategic leverage. If it can manage its capital intensity and maintain execution discipline, CoreWeave could become a dominant force in next-generation cloud computing. But the path forward is not without risk.

About The Author

Sia Gholami

Sia Gholami is a distinguished expert in the intersection of

artificial intelligence and finance. He holds a bachelor's, master's, and Ph.D. in computer

science, with his doctoral thesis focused on efficient large language models and their

applications—an area crucial to the development of advanced AI systems. Specializing in machine

learning and artificial intelligence, Sia has authored several research papers published in

peer-reviewed venues, establishing his authority in both academic and professional circles.

Sia has created AI models and systems specifically designed to identify opportunities in the

public market, leveraging his expertise to develop cutting-edge financial technologies. His most

recent role was at Amazon, where he worked within Amazon Ads, developing and deploying AI and

machine learning models to production with remarkable success. This experience, combined with

his deep technical knowledge and understanding of financial systems, positions Sia as a leading

figure in AI-driven financial technologies. His extensive background has also led him to found

and lead successful ventures, driving innovation at the convergence of AI and finance.