The Trade Desk Beats Q1 Estimates - Strong Revenue Drive 19% Post-Earnings Rally

- Sia Gholami

- /

- May 11, 2025

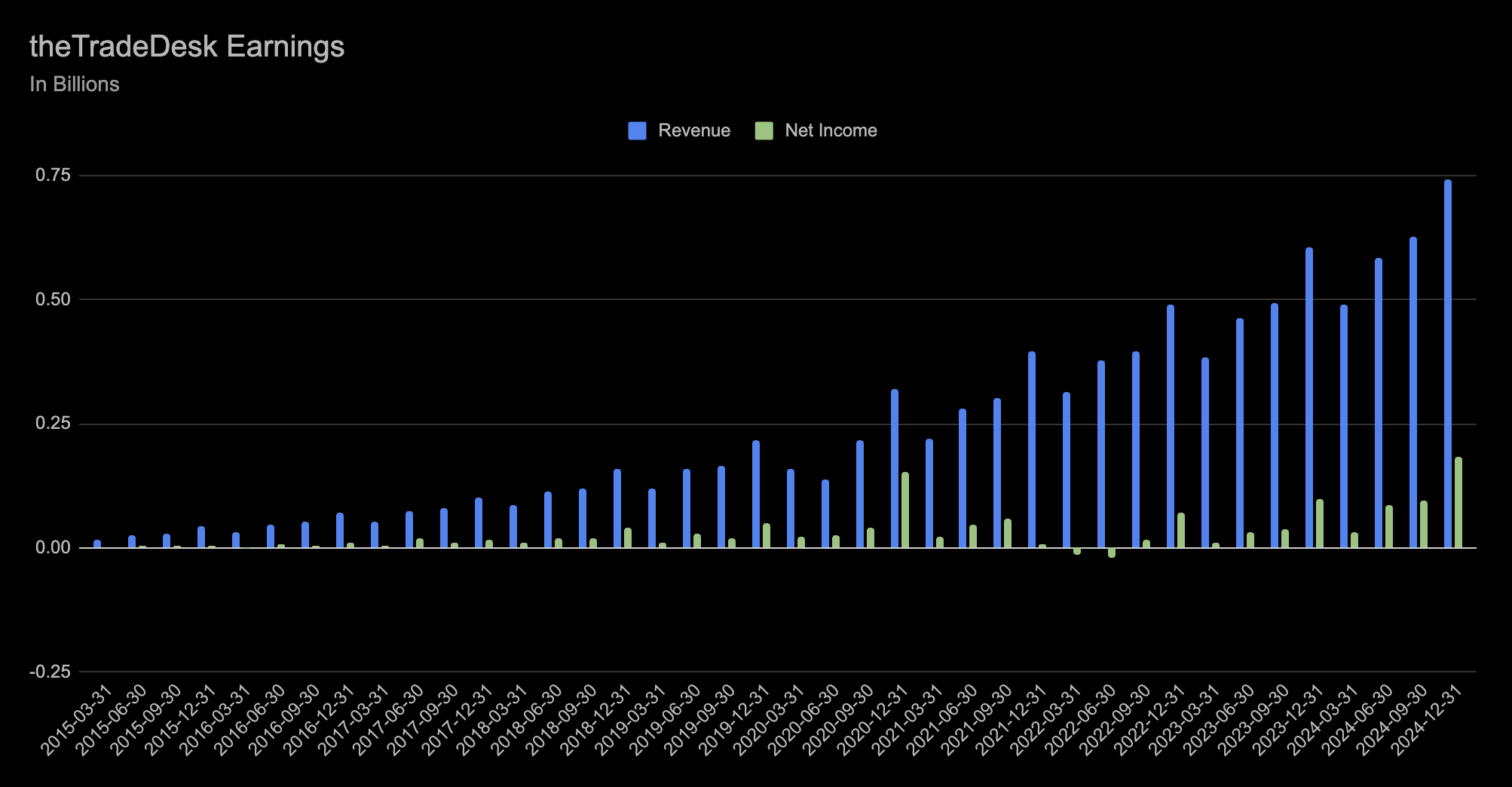

The Trade Desk (NASDAQ: TTD) reported first-quarter 2025 earnings that exceeded Wall Street expectations on both revenue and earnings, following a rare miss in the prior quarter. Revenue reached $616 million, up 25% year-over-year, while non-GAAP earnings per share came in at $0.33, well above the $0.25 consensus estimate. Adjusted EBITDA rose to $208 million, reflecting a 34% margin. GAAP net income was $50.7 million, compared to $31.7 million in the same period last year.

The company noted that adoption of its AI-powered platform, Kokai, continues to expand, with approximately two-thirds of clients using it by the end of Q1. Leadership changes were also announced, including the appointment of Vivek Kundra, former U.S. Chief Information Officer and Salesforce executive, as Chief Operating Officer. Additionally, The Trade Desk completed the acquisition of digital ad data firm Sincera and highlighted further global adoption of its Unified ID 2.0 framework, alongside new OpenPath integrations with publishers such as Warner Bros. Discovery and The Guardian.

Following the report, shares of The Trade Desk rose nearly 19%, reflecting a strong market reaction to the results. While investor sentiment was positive, it comes amid an ad tech environment still adjusting to changes in privacy regulations, identity frameworks, and broader macroeconomic headwinds.

For the second quarter, the company guided to at least $682 million in revenue and approximately $259 million in adjusted EBITDA. These figures suggest The Trade Desk anticipates continued strength in advertiser demand through mid-year, but they remain subject to external factors affecting the broader digital advertising market.

About The Author

Sia Gholami

Sia Gholami is a distinguished expert in the intersection of

artificial intelligence and finance. He holds a bachelor's, master's, and Ph.D. in computer

science, with his doctoral thesis focused on efficient large language models and their

applications—an area crucial to the development of advanced AI systems. Specializing in machine

learning and artificial intelligence, Sia has authored several research papers published in

peer-reviewed venues, establishing his authority in both academic and professional circles.

Sia has created AI models and systems specifically designed to identify opportunities in the

public market, leveraging his expertise to develop cutting-edge financial technologies. His most

recent role was at Amazon, where he worked within Amazon Ads, developing and deploying AI and

machine learning models to production with remarkable success. This experience, combined with

his deep technical knowledge and understanding of financial systems, positions Sia as a leading

figure in AI-driven financial technologies. His extensive background has also led him to found

and lead successful ventures, driving innovation at the convergence of AI and finance.