Q1 2025 Cloud Earnings: AWS, Azure, and Google Cloud Show Diverging Strengths

- Sia Gholami

- /

- May 4, 2025

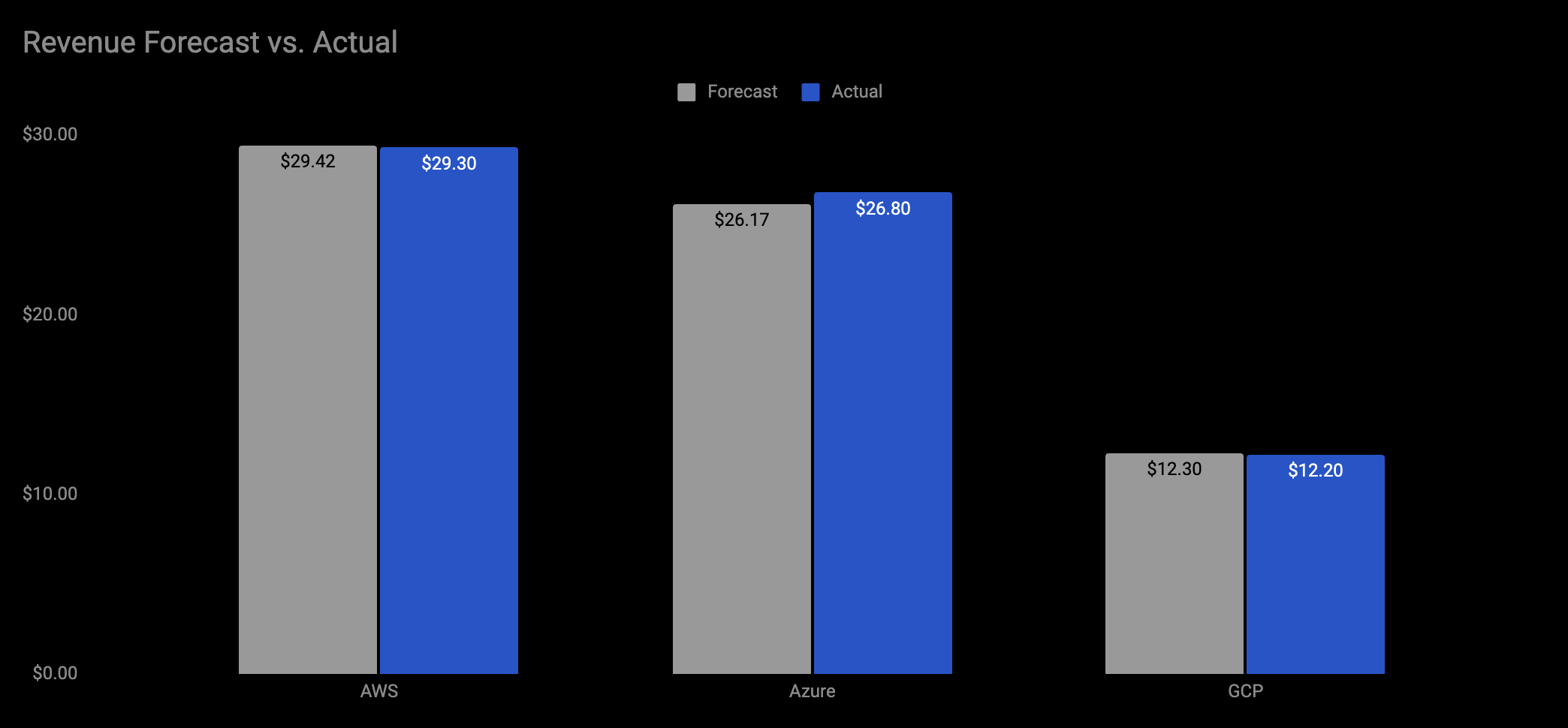

In the first quarter of 2025, the three leading cloud providers—Amazon Web Services (AWS), Microsoft Azure, and Google Cloud—reported robust revenue growth, though with clear differences in scale and momentum. AWS remained the market leader, generating $29.3 billion in revenue, representing a 17% year-over-year increase, driven by demand for foundational cloud infrastructure and enterprise services. Microsoft Azure, reported under the broader “Server Products and Cloud Services” segment, reached an estimated $24.8 billion, with 22% annual growth, largely fueled by consumption-based services and AI workloads. Google Cloud posted $12.2 billion in revenue, with the highest growth rate of 28%, supported by strength in data analytics, AI/ML platforms, and Google Workspace integration with its cloud infrastructure.

Earnings calls provided deeper insights into what is driving each platform’s performance and how they are positioning for future dominance. Microsoft emphasized that Azure’s growth was bolstered by strong usage of Azure OpenAI Service, which now supports mission-critical workloads across sectors including healthcare, financial services, and government. CEO Satya Nadella highlighted a surge in inference and training workloads, with enterprises increasingly deploying large-scale models through Azure Machine Learning and Fabric, Microsoft’s new data integration platform. However, Microsoft also clarified that the majority of Azure’s growth this quarter came from non-AI workloads, signaling that traditional cloud infrastructure and platform services still represent the core of enterprise demand. AWS, while facing slower growth, remains profitable and deeply embedded in enterprise IT. CEO Andy Jassy pointed to increased adoption of Amazon Bedrock (its GenAI foundation model service), SageMaker upgrades, and new Trainium2-based instances aimed at reducing inference cost per token. He also reiterated that 85% of global IT spend is still on-premises (referred to as CRAM: compute, storage, databases, and networking) and is expected to shift to the cloud over time. While this figure is debated in the industry—some argue it overstates the addressable opportunity—it nonetheless underscores AWS’s long-term thesis that cloud migration is far from complete. Google Cloud, which turned profitable last year, continued to gain traction via Vertex AI, BigQuery, and its unified Data Cloud stack. CEO Sundar Pichai noted strong wins in industries like retail and media, and touted the integration of Gemini models across Google Cloud services and productivity apps.

All three hyperscalers are converging on the same strategic pillars: AI-native services, data unification, and vertical-specific cloud solutions. Microsoft is pushing a fully integrated ecosystem that spans Azure, Copilot (across Office and GitHub), and its growing on-prem/cloud hybrid capabilities with Azure Arc. It is also rapidly investing in AI datacenter infrastructure, with capex reaching $21.4 billion. AWS, while less aggressive on AI narratives than its peers, is quietly investing in custom silicon (Trainium, Inferentia), serverless AI pipelines, and expanding Local Zones for latency-sensitive applications. Google Cloud’s bet is on openness and ecosystem integration, leveraging multi-cloud tools like Anthos, and a more modular AI strategy that appeals to enterprises wary of vendor lock-in. Notably, all three expect AI-related workloads to become a larger share of their compute and storage consumption, though monetization models (e.g., pay-per-token, fine-tuned models, API usage) are still evolving and may pressure margins over time.

Q1 2025 earnings reinforced the divergence in strategy and performance among the top cloud providers. AWS holds the lead in raw revenue and global infrastructure footprint, but is growing more slowly. Microsoft Azure is accelerating, supported by AI integration and deep enterprise entrenchment, particularly where Microsoft 365 and GitHub are embedded. Google Cloud is showing the fastest growth, backed by AI leadership and product modernization, though it remains the smallest in revenue terms. As cloud adoption matures and AI moves into production at scale, differentiation will shift from general-purpose infrastructure to ecosystem breadth, developer velocity, and ability to support regulated, industry-specific environments. The hyperscaler with the most adaptive and AI-enabled stack may ultimately define the next decade of enterprise IT.

About The Author

Sia Gholami

Sia Gholami is a distinguished expert in the intersection of

artificial intelligence and finance. He holds a bachelor's, master's, and Ph.D. in computer

science, with his doctoral thesis focused on efficient large language models and their

applications—an area crucial to the development of advanced AI systems. Specializing in machine

learning and artificial intelligence, Sia has authored several research papers published in

peer-reviewed venues, establishing his authority in both academic and professional circles.

Sia has created AI models and systems specifically designed to identify opportunities in the

public market, leveraging his expertise to develop cutting-edge financial technologies. His most

recent role was at Amazon, where he worked within Amazon Ads, developing and deploying AI and

machine learning models to production with remarkable success. This experience, combined with

his deep technical knowledge and understanding of financial systems, positions Sia as a leading

figure in AI-driven financial technologies. His extensive background has also led him to found

and lead successful ventures, driving innovation at the convergence of AI and finance.