Netflix’s Big Play: Strong earnings now, bold expansion by 2030

- Sia Gholami

- /

- Apr 20, 2025

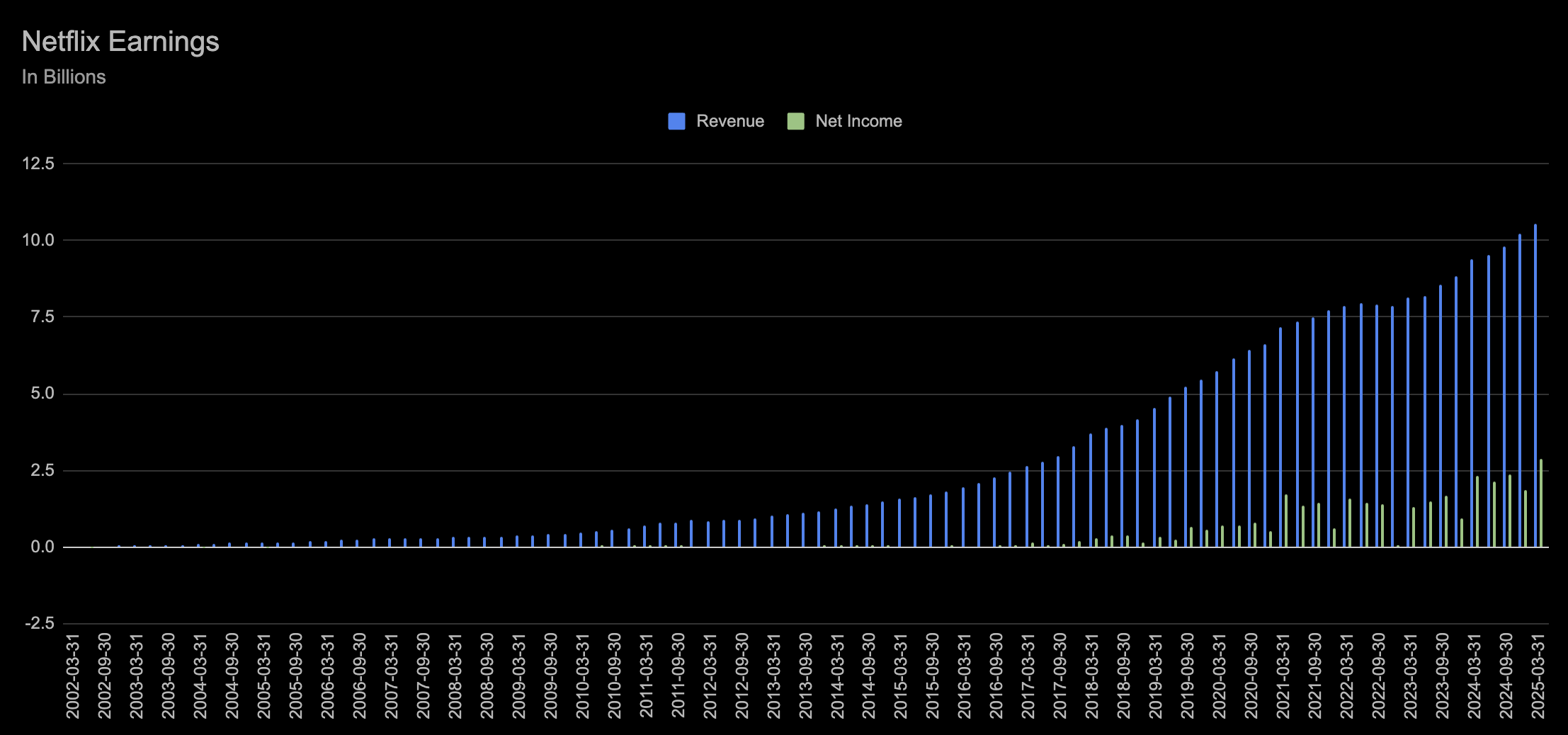

Netflix posted impressive first-quarter results for 2025, beating Wall Street expectations across the board. The company reported revenue of $10.54 billion, a 13% year-over-year increase, with net income climbing to $2.9 billion. Earnings per share came in at $6.61, significantly above the $5.68 consensus estimate. Operating income reached $3.3 billion, bolstered by recent price increases and early gains from its expanding ad-supported tier. Notably, Netflix opted not to disclose quarterly subscriber numbers for the first time, shifting investor focus toward profitability and long-term margin improvement. The company reaffirmed its 2025 full-year guidance, projecting revenue between $43.5 billion and $44.5 billion and a 29% operating margin.

In a recent internal strategy meeting, Netflix executives unveiled ambitious plans to double annual revenue to approximately $80 billion and triple operating income to $30 billion by 2030. The company aims to expand its global subscriber base from around 300 million to 410 million, focusing on high-growth markets such as India and Brazil. Additionally, Netflix targets $9 billion in annual advertising revenue by 2030, up from an estimated $500 million in 2025. These goals are part of a broader strategy to achieve a $1 trillion market capitalization by the end of the decade.

What distinguishes Netflix from many of its tech peers is its relatively low exposure to global macroeconomic risks, particularly those stemming from tariffs, geopolitical tensions, or supply chain disruptions. As a digitally native content platform with minimal physical infrastructure, Netflix operates largely outside the direct impact zones of international trade friction. Additionally, the company is less susceptible to trends currently upending other sectors of technology, such as hardware commoditization, AI disintermediation, or reliance on third-party app ecosystems. Its vertical integration in content production and distribution gives it strong strategic insulation.

However, the path forward is not without challenges. Netflix now competes not only with traditional studios and streaming platforms but also with emerging forms of digital entertainment including user-generated content, live streams, and gaming. While the advertising business is a promising lever for growth, execution risk remains high, particularly with the company transitioning to its in-house adtech stack. Moreover, content spending will need to be carefully managed to sustain margin expansion without eroding viewer engagement. Regulatory risks in international markets, including data localization and cultural compliance, also present potential friction points.

Overall, Netflix continues to demonstrate a disciplined approach to growth, prioritizing operating leverage and business model evolution over vanity metrics. Its ability to maintain momentum in a shifting digital landscape, while remaining relatively insulated from external shocks, is a testament to the resilience of its strategy. As competitors restructure and macroeconomic headwinds persist, Netflix appears well-positioned to remain a long-term winner in the global media ecosystem.

About The Author

Sia Gholami

Sia Gholami is a distinguished expert in the intersection of

artificial intelligence and finance. He holds a bachelor's, master's, and Ph.D. in computer

science, with his doctoral thesis focused on efficient large language models and their

applications—an area crucial to the development of advanced AI systems. Specializing in machine

learning and artificial intelligence, Sia has authored several research papers published in

peer-reviewed venues, establishing his authority in both academic and professional circles.

Sia has created AI models and systems specifically designed to identify opportunities in the

public market, leveraging his expertise to develop cutting-edge financial technologies. His most

recent role was at Amazon, where he worked within Amazon Ads, developing and deploying AI and

machine learning models to production with remarkable success. This experience, combined with

his deep technical knowledge and understanding of financial systems, positions Sia as a leading

figure in AI-driven financial technologies. His extensive background has also led him to found

and lead successful ventures, driving innovation at the convergence of AI and finance.