Bank Earnings Roundup: JPMorgan, Morgan Stanley, and Wells Fargo Beat Expectations Amid Economic Headwinds

- Sia Gholami

- /

- Apr 13, 2025

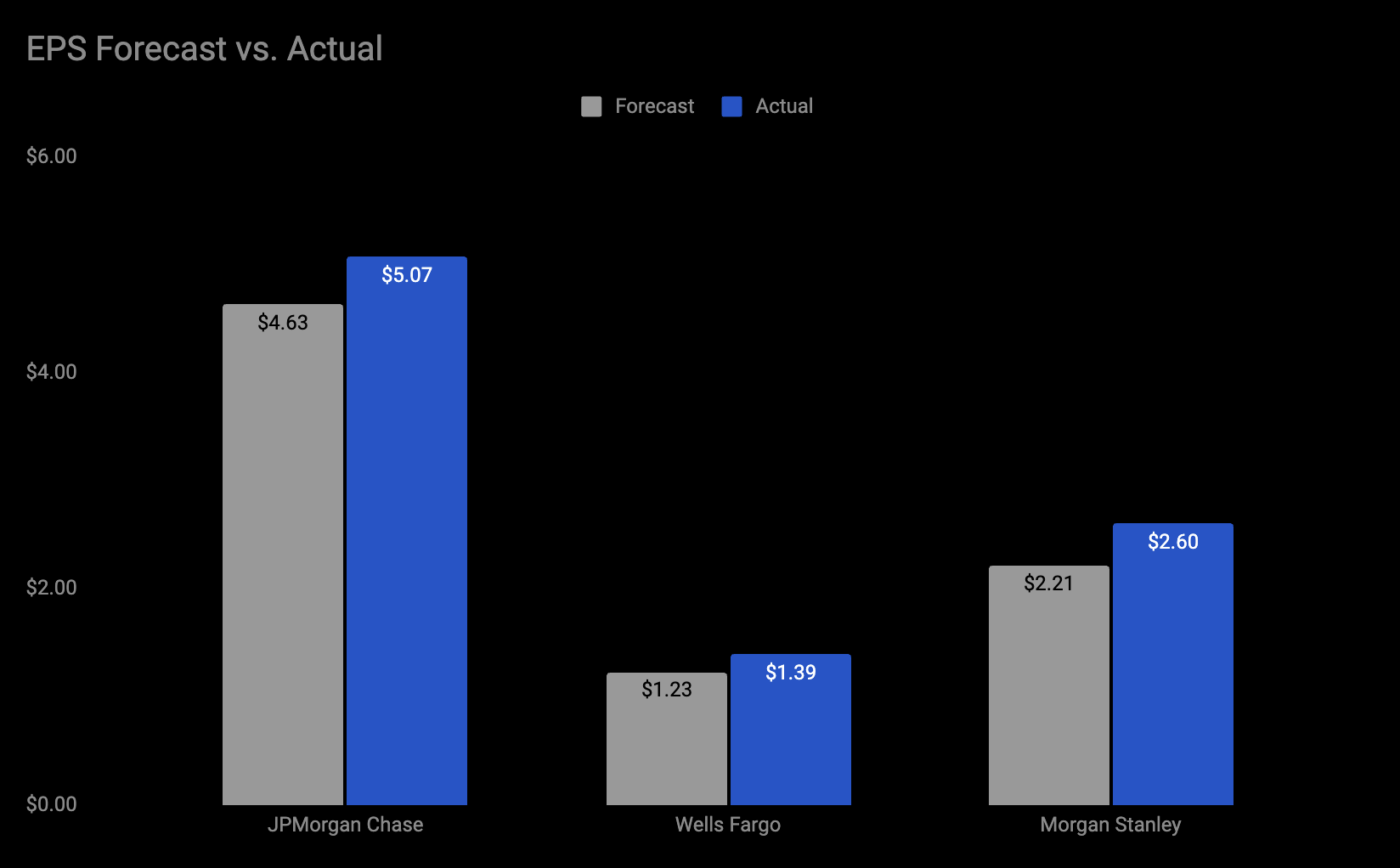

In the first quarter of 2025, major U.S. banks reported earnings that surpassed Wall Street estimates, reinforcing their financial resilience even as macroeconomic uncertainty looms. JPMorgan Chase posted $45.3 billion in revenue, up 8% year-over-year, with net income rising 9% to $14.6 billion—significantly above analyst forecasts. Morgan Stanley recorded $17.7 billion in revenue, a 17% increase, and net income of $4.3 billion, up 26% from the prior year. Wells Fargo reported $20.15 billion in revenue, slightly down 3% year-over-year, but delivered $4.89 billion in net income, a 6% increase, with EPS of $1.39, also ahead of expectations. Strong equities trading, steady wealth management growth, and improved investment banking activity contributed to the outperformance.

Despite the positive results, forward guidance from bank executives was notably cautious. JPMorgan CEO Jamie Dimon stated that while markets remain resilient in the short term, the long-term risks are building, describing the current environment as fraught with “considerable turbulence.” He highlighted persistent inflation, rising fiscal deficits, and geopolitical instability—particularly in relation to trade and monetary policy—as threats to economic stability. Morgan Stanley echoed this sentiment, warning that the tailwinds in trading may not be sustainable if macro conditions deteriorate. Executives also pointed to the risk of a slowdown in mergers and acquisitions as tighter credit conditions and higher uncertainty weigh on corporate activity. At Wells Fargo, CEO Charlie Scharf acknowledged that loan growth may moderate, especially in consumer and commercial lending, as both borrowers and lenders become more cautious. All three banks raised their provisions for credit losses, with JPMorgan increasing its allowance to $3.3 billion, signaling a more defensive posture moving forward.

One of the most immediate macroeconomic headwinds facing these institutions is the resurgence of protectionist trade policies. The recent wave of tariffs introduced by the U.S. government has intensified concerns about global supply chain disruptions, inflationary pressures, and retaliatory actions from key trading partners. While the tariffs are aimed at specific sectors and regions, their ripple effects could be far-reaching. For the broader economy, higher input costs and reduced trade efficiency may slow consumer spending, weaken corporate earnings, and dampen business investment. These dynamics are particularly relevant for large financial institutions whose performance is closely tied to the health of the global and domestic economy. JPMorgan and Morgan Stanley, with sizable international and multinational corporate client portfolios, are especially sensitive to declines in cross-border transactions, trade finance activity, and capital markets issuance. Even Wells Fargo, which has a more U.S.-focused footprint, could face pressure from slower loan growth, rising delinquencies, and reduced fee income if consumer and small business confidence erodes. In essence, if tariffs contribute to a broader economic slowdown, the banking sector could see both top-line and credit quality impacts in the quarters ahead.

While the Q1 results showcased strength in market-facing segments and disciplined cost control, the macro backdrop is growing more complex. The strong start to the ear for these institutions underscores their operational leverage and strategic diversification, but forward returns will likely hinge on how successfully they navigate a slowing economy, policy shocks, and geopolitical volatility. Investors will be watching closely in Q2 to see whether resilience persists—or if earnings tailwinds give way to external headwinds.

About The Author

Sia Gholami

Sia Gholami is a distinguished expert in the intersection of

artificial intelligence and finance. He holds a bachelor's, master's, and Ph.D. in computer

science, with his doctoral thesis focused on efficient large language models and their

applications—an area crucial to the development of advanced AI systems. Specializing in machine

learning and artificial intelligence, Sia has authored several research papers published in

peer-reviewed venues, establishing his authority in both academic and professional circles.

Sia has created AI models and systems specifically designed to identify opportunities in the

public market, leveraging his expertise to develop cutting-edge financial technologies. His most

recent role was at Amazon, where he worked within Amazon Ads, developing and deploying AI and

machine learning models to production with remarkable success. This experience, combined with

his deep technical knowledge and understanding of financial systems, positions Sia as a leading

figure in AI-driven financial technologies. His extensive background has also led him to found

and lead successful ventures, driving innovation at the convergence of AI and finance.