Global Tariffs, Local Shocks: How Broad-Based Trade Duties Are Reshaping Market Dynamics

- Sia Gholami

- /

- Apr 06, 2025

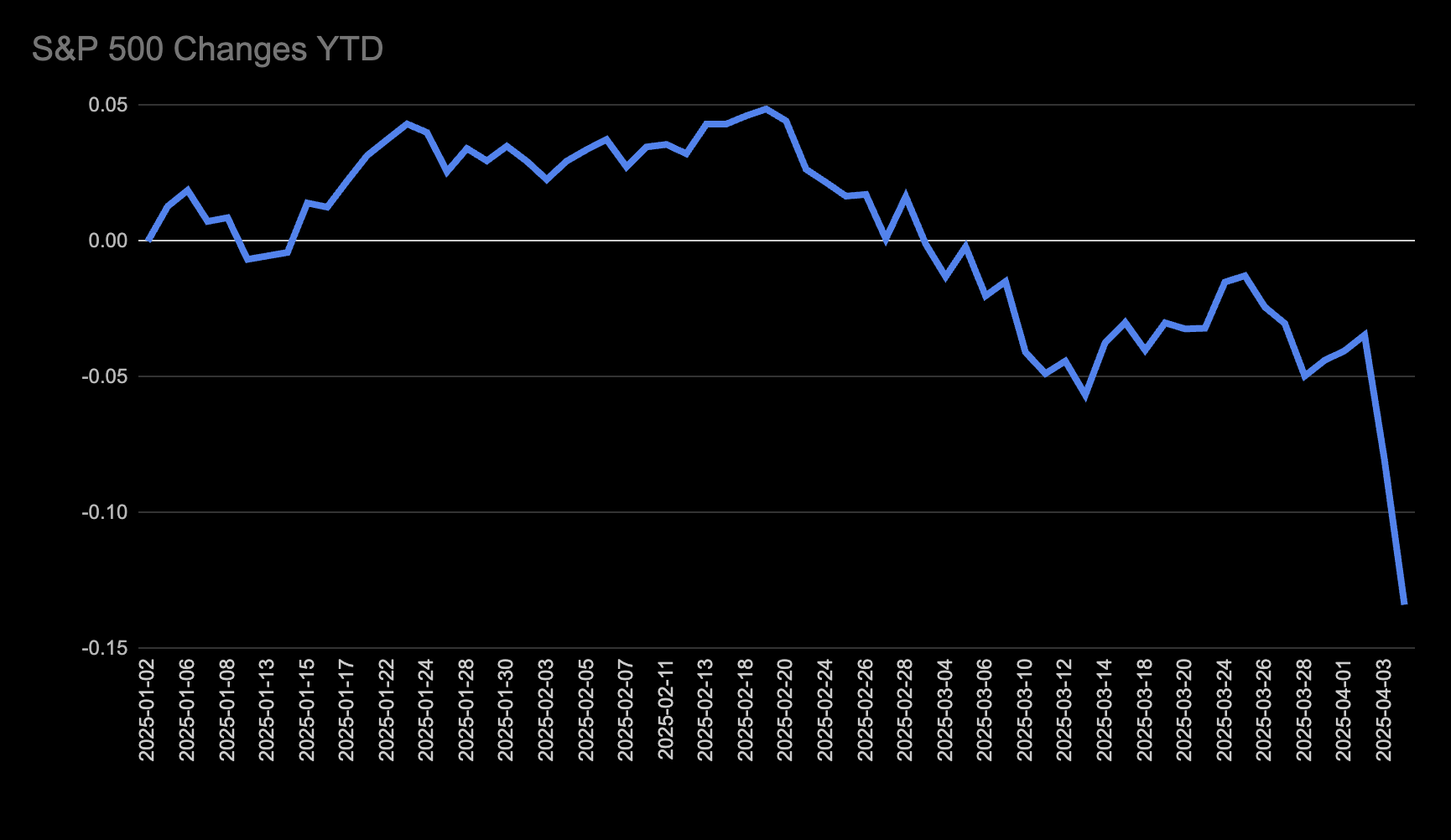

The Effects of Tariffs on the Stock Market

President Trump recently announced a sweeping tariff measure that imposes a 10% duty on virtually all imports into the United States, effective April 5, 2025. Implemented under the authority of the International Emergency Economic Powers Act (IEEPA), this action represents one of the most expansive applications of protectionist trade policy in recent U.S. history. Unlike previous tariffs targeted at specific countries such as China, this new framework applies globally, with some nations subject to reciprocal tariffs ranging from 11% to 50%. The policy is framed as a response to persistent trade deficits, national economic vulnerabilities, and the perceived need to restore competitive conditions for U.S. industry in the face of longstanding asymmetries in international trade.

The stock market has responded with heightened volatility and broad-based declines, reflecting both direct and systemic risks. Companies that rely heavily on imported intermediate goods—particularly in manufacturing, retail, and consumer electronics—are facing immediate margin pressure due to elevated input costs. These firms may be forced to raise prices or reduce earnings guidance, both of which negatively affect equity valuations. At the same time, companies with minimal exposure to foreign supply chains but significant reliance on domestic consumer demand are also under stress. Investors fear that tariffs could contribute to inflationary pressures, reduced household purchasing power, and ultimately, recessionary dynamics that would impair revenue growth. Moreover, growth-oriented companies, especially those with high valuation multiples—such as those in the technology and communication services sectors—are particularly vulnerable. In an economic downturn, the long-duration cash flows that justify their premium valuations become subject to significant discounting, leading to sharper drawdowns relative to value-oriented or defensive sectors.

Should these tariff-induced pressures contribute to a contraction in economic activity, the Federal Reserve would likely be compelled to respond by easing monetary policy. A recession would create the macroeconomic conditions for the Fed to lower interest rates in an effort to stimulate growth and stabilize financial markets. This easing cycle would have an important secondary effect: reducing the cost of servicing the federal government’s debt. As of early April 2025, total U.S. national debt exceeds $36 trillion, with over $8 trillion in Treasuries expected to mature and refinance within the next 12 months. In fiscal year 2024, the federal government paid more than $800 billion in interest—now one of the largest single line items in the budget. A meaningful reduction in interest rates, even by 100 basis points, could translate into annual interest savings of more than $80 billion over time. In this sense, while the tariff policy increases near-term recession risk, it could prompt a monetary policy response that relieves fiscal pressure over the medium term.

Looking ahead, the path forward is highly uncertain and will depend on how the U.S. government and its trading partners navigate this evolving policy landscape. One scenario involves a prolonged and escalating trade conflict. If other countries respond with broad-based retaliatory tariffs on U.S. exports, global trade volumes could contract sharply. This would weaken demand for U.S. goods abroad, depress export-related revenues, and disrupt multinational supply chains. Such a development could impair capital expenditure, increase geopolitical risk premiums, and lead to sustained underperformance in cyclical sectors. The net result could be a policy-induced recession, where both corporate earnings and labor market conditions deteriorate simultaneously.

A more optimistic scenario is that the tariffs serve as a strategic bargaining tool designed to extract concessions from trading partners. Under this outcome, the U.S. leverages the threat of tariffs to renegotiate trade terms, resulting in new bilateral or multilateral agreements that reduce trade imbalances while avoiding the worst-case economic outcomes. If successfully executed, this could restore investor confidence, stabilize corporate earnings expectations, and lead to a relief rally in risk assets. However, such a path would require sophisticated diplomacy, credible enforcement mechanisms, and coordination across industries affected by retaliatory measures.

A third possibility is the partial rollback or modification of the tariff policy due to domestic political, economic, or legal pressures. For example, if consumer prices accelerate significantly or job losses mount in sectors sensitive to global input costs, public and congressional opposition could intensify. Legal challenges to the use of IEEPA for broad economic measures—especially if deemed outside its original intent—could also constrain the executive branch’s ability to maintain the tariffs indefinitely. A court-ordered injunction or legislative override would materially alter the policy landscape and could trigger a rapid reversal in market sentiment.

Across all scenarios, investor focus will remain on the interplay between trade policy, monetary response, and macroeconomic indicators. Earnings revisions, inflation trends, labor market data, and central bank guidance will be critical signals for assessing whether the U.S. is on a path toward resilience or systemic risk. Portfolio positioning will likely reflect this uncertainty, with greater emphasis on downside protection, factor rotation, and capital allocation to defensive or domestic-oriented sectors.

About The Author

Sia Gholami

Sia Gholami is a distinguished expert in the intersection of

artificial intelligence and finance. He holds a bachelor's, master's, and Ph.D. in computer

science, with his doctoral thesis focused on efficient large language models and their

applications—an area crucial to the development of advanced AI systems. Specializing in machine

learning and artificial intelligence, Sia has authored several research papers published in

peer-reviewed venues, establishing his authority in both academic and professional circles.

Sia has created AI models and systems specifically designed to identify opportunities in the

public market, leveraging his expertise to develop cutting-edge financial technologies. His most

recent role was at Amazon, where he worked within Amazon Ads, developing and deploying AI and

machine learning models to production with remarkable success. This experience, combined with

his deep technical knowledge and understanding of financial systems, positions Sia as a leading

figure in AI-driven financial technologies. His extensive background has also led him to found

and lead successful ventures, driving innovation at the convergence of AI and finance.