Okta Reports Strong Q4 Earnings, But Challenges Remain: Revenue Growth, AI Innovation, and Market Volatility Shape the Outlook

- Sia Gholami

- /

- Mar 9, 2025

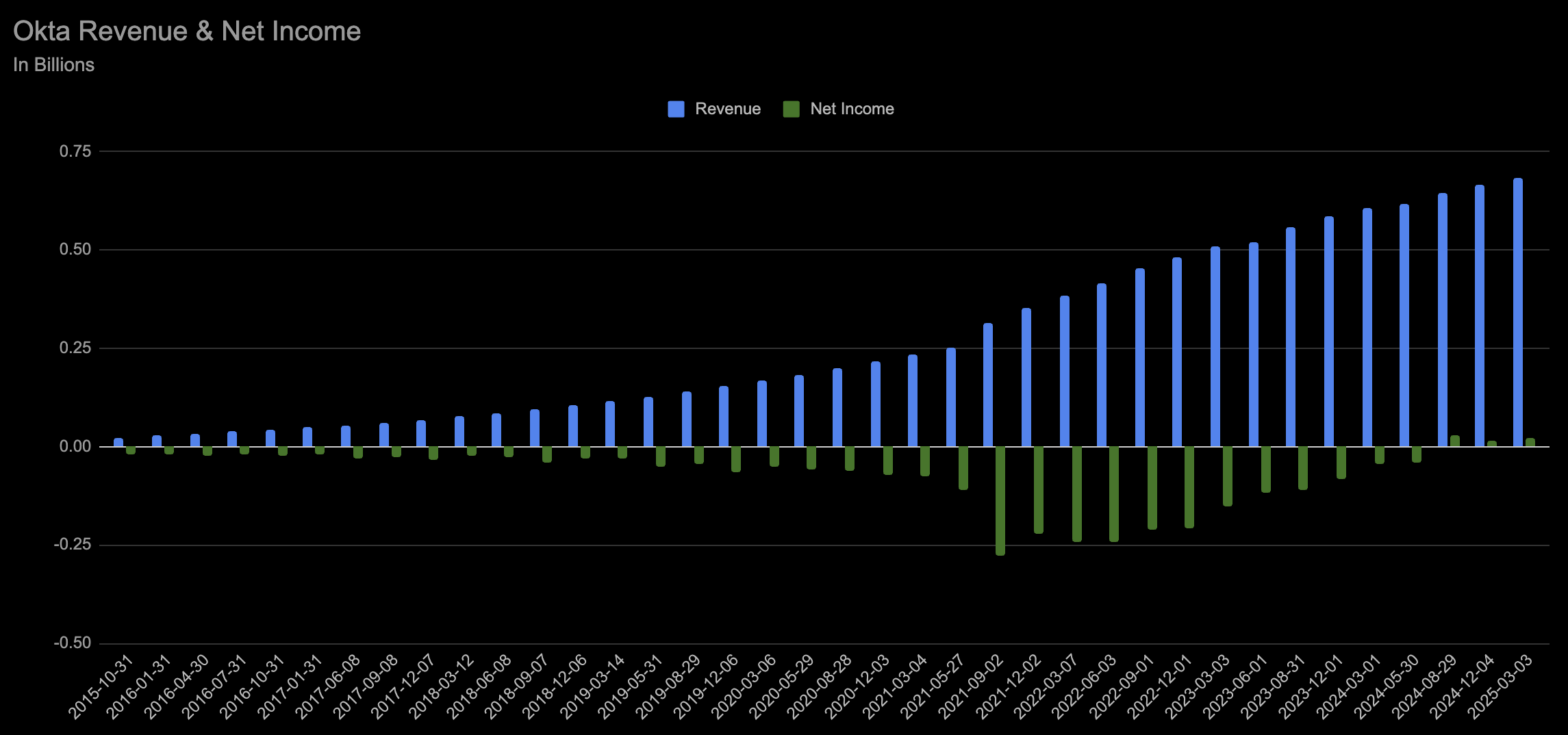

Okta Inc. (NASDAQ: OKTA), a leading provider of identity and access management solutions, recently announced its fourth-quarter and full-year fiscal 2025 results, showing solid revenue growth and improved profitability. The company reported $682 million in revenue, a 13% year-over-year increase, driven primarily by strong subscription revenue of $670 million. Okta also posted a GAAP operating income of $8 million, a notable turnaround from last year’s $83 million loss. Non-GAAP operating income stood at $168 million, representing 25% of revenue, an improvement from 21% the prior year. Net income also improved significantly, with GAAP net income reaching $23 million compared to a $44 million loss last year, while non-GAAP EPS rose to $0.78 per share.

One of the key takeaways from our research is the increasing commoditization of Infrastructure as a Service (IaaS), making price the primary differentiator. However, Platform as a Service (PaaS) offerings are evolving rapidly, with cloud providers adding advanced AI, big data analytics, and industry-specific solutions. The demand for AI-driven cloud services is also rising as businesses look to leverage automation and real-time insights. These trends are driving aggressive innovation among cloud providers while also intensifying pricing competition.

Factors Driving Okta’s Growth

- Enterprise Adoption: Large enterprises continue to adopt Okta’s identity solutions, expanding its customer base and increasing recurring revenue. The company’s Remaining Performance Obligations (RPO) grew 25% year-over-year to $4.2 billion, with a 15% increase in current RPO to $2.2 billion, reflecting strong demand.

- AI-Powered Security Enhancements: CEO Todd McKinnon emphasized Okta’s growing use of AI in cybersecurity, enabling customers to automate security processes and improve identity verification. These innovations position Okta to remain competitive in a fast-evolving security landscape.

- Strategic Partnerships and Expansion: Okta’s collaboration with AWS Marketplace contributed to an 80% revenue increase from the platform, demonstrating its ability to scale through key partnerships.

Market Reaction and Analyst Sentiment

Following the earnings announcement, Okta’s stock surged 19%, marking its strongest single-day performance in over a year. Analysts responded positively, with Mizuho Securities upgrading its rating to "Outperform" and raising its price target from $110 to $127. Additionally, Okta’s IBD SmartSelect Composite Rating climbed to 97, placing it among the top 3% of all stocks based on financial and technical performance.

Risks and Challenges Ahead

Despite the strong earnings report, Okta faces several challenges that could impact its future performance. The cybersecurity industry is highly competitive, with Microsoft and other identity management firms expanding their presence in the space. Additionally, while AI-driven security solutions offer long-term potential, implementation costs and regulatory considerations could slow adoption. Okta also continues to work on restoring trust after past security breaches, and maintaining customer confidence remains critical for sustained growth.

Looking Ahead

Okta has provided a positive outlook for fiscal year 2026, forecasting revenue between $2.85 billion and $2.86 billion, above market expectations. The company also anticipates Q1 revenue of $678 million to $680 million, signaling continued momentum. While challenges remain, Okta’s expanding enterprise presence, AI-driven innovation, and strategic partnerships place it in a strong position within the identity security market. However, investors will be watching closely to see if the company can maintain its growth trajectory while managing risks in a competitive landscape.

About The Author

Sia Gholami

Sia Gholami is a distinguished expert in the intersection of

artificial intelligence and finance. He holds a bachelor's, master's, and Ph.D. in computer

science, with his doctoral thesis focused on efficient large language models and their

applications—an area crucial to the development of advanced AI systems. Specializing in machine

learning and artificial intelligence, Sia has authored several research papers published in

peer-reviewed venues, establishing his authority in both academic and professional circles.

Sia has created AI models and systems specifically designed to identify opportunities in the

public market, leveraging his expertise to develop cutting-edge financial technologies. His most

recent role was at Amazon, where he worked within Amazon Ads, developing and deploying AI and

machine learning models to production with remarkable success. This experience, combined with

his deep technical knowledge and understanding of financial systems, positions Sia as a leading

figure in AI-driven financial technologies. His extensive background has also led him to found

and lead successful ventures, driving innovation at the convergence of AI and finance.