Robinhood's Big Quarter: Soaring Earnings and Crypto Boom

- Sia Gholami

- /

- Feb 23, 2025

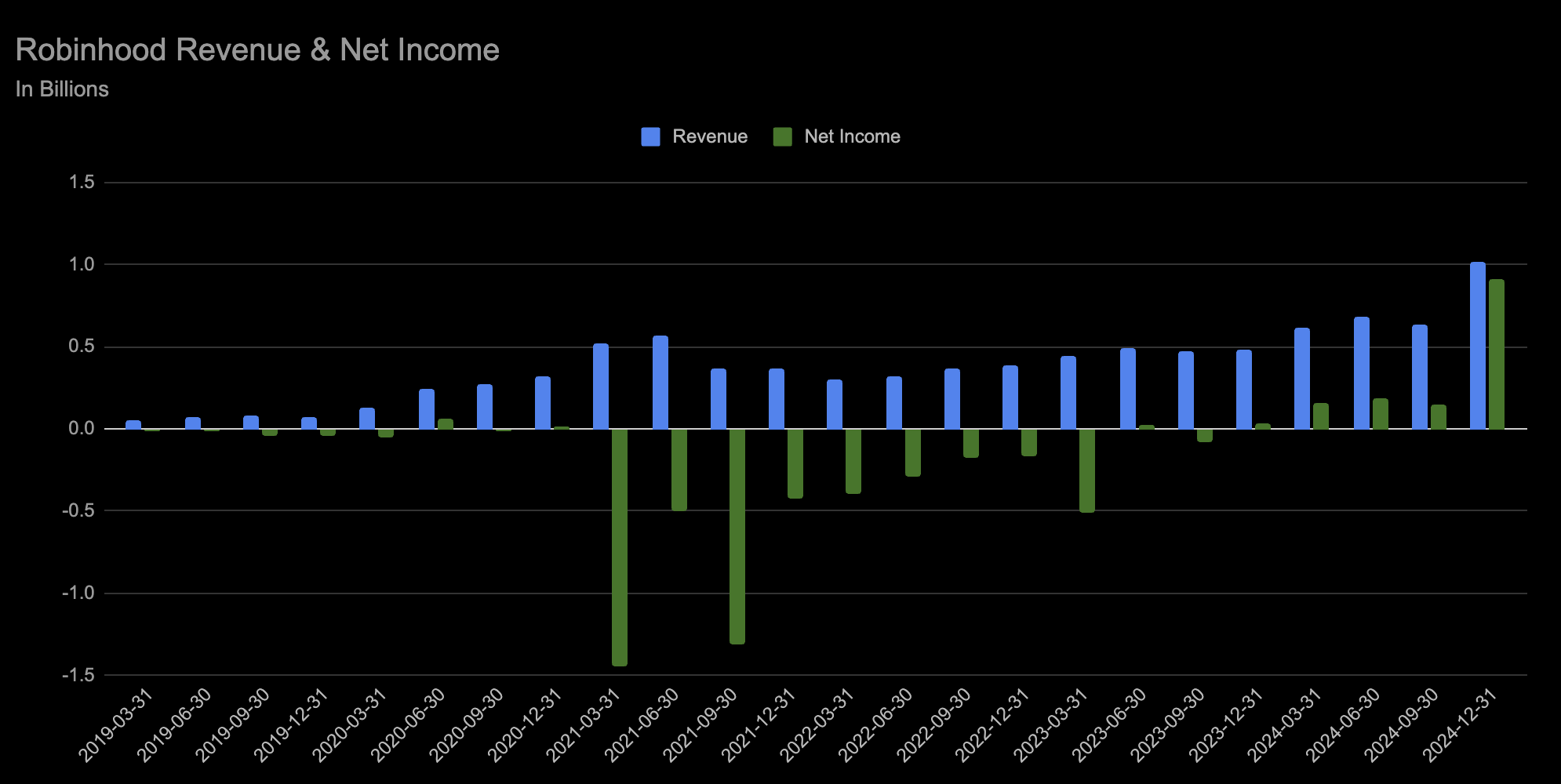

Robinhood (NASDAQ: HOOD) delivered a standout fourth-quarter 2024 earnings report, surpassing expectations and reinforcing its position as a key player in retail trading. The company reported $1.01 billion in revenue, marking a 115% year-over-year increase. Transaction-based revenues surged, hitting $672 million, largely driven by a 700% jump in cryptocurrency trading revenue, which totaled $358 million. Net interest revenues also grew 25% year-over-year to $296 million, while net income skyrocketed to $916 million, compared to just $30 million in Q4 2023. The company’s assets under custody (AUC) rose 88% to $193 billion, benefiting from both user deposits and higher asset valuations. Following the earnings release, Robinhood’s stock climbed 14%, reaching an all-time high of $63.80.

The main driver behind Robinhood’s impressive results was the resurgence in cryptocurrency trading. With Bitcoin and other digital assets experiencing a major rally, fueled by Bitcoin ETF approvals and anticipation of the Bitcoin halving event, retail traders returned to the platform in full force. Increased market volatility also played a role, as traders sought opportunities in both crypto and equities, generating more transaction fees for Robinhood. Additionally, higher interest rates boosted net interest revenues, as the company earned more from interest on customer balances and margin loans.

Beyond market-driven factors, Robinhood’s strategic moves also contributed to its strong quarter. The platform has expanded its offerings, including retirement accounts, stock lending programs, and new trading features, increasing engagement among users. Its referral program and marketing efforts have helped attract new customers, further growing its assets under custody.

Despite these positive results, there are reasons for caution. Robinhood remains highly dependent on trading volume, which can fluctuate based on market conditions. If the crypto rally cools or stock market volatility decreases, transaction revenues could decline. Additionally, regulatory scrutiny over payment-for-order-flow (PFOF) and crypto trading could present challenges in the future. While the company has worked to diversify its revenue streams, it is still vulnerable to external factors outside its control.

Robinhood’s Q4 earnings highlight the company’s ability to capitalize on market trends and expand its platform. However, its reliance on volatile trading activity means that maintaining this level of performance is not guaranteed. Investors will be watching closely to see if Robinhood can sustain its momentum as market conditions evolve.

About The Author

Sia Gholami

Sia Gholami is a distinguished expert in the intersection of

artificial intelligence and finance. He holds a bachelor's, master's, and Ph.D. in computer

science, with his doctoral thesis focused on efficient large language models and their

applications—an area crucial to the development of advanced AI systems. Specializing in machine

learning and artificial intelligence, Sia has authored several research papers published in

peer-reviewed venues, establishing his authority in both academic and professional circles.

Sia has created AI models and systems specifically designed to identify opportunities in the

public market, leveraging his expertise to develop cutting-edge financial technologies. His most

recent role was at Amazon, where he worked within Amazon Ads, developing and deploying AI and

machine learning models to production with remarkable success. This experience, combined with

his deep technical knowledge and understanding of financial systems, positions Sia as a leading

figure in AI-driven financial technologies. His extensive background has also led him to found

and lead successful ventures, driving innovation at the convergence of AI and finance.