Investors Are Lovin’ the AppLovin: Strong Earnings Surprise, But a Competitive Road Ahead

- Sia Gholami

- /

- Feb 16, 2025

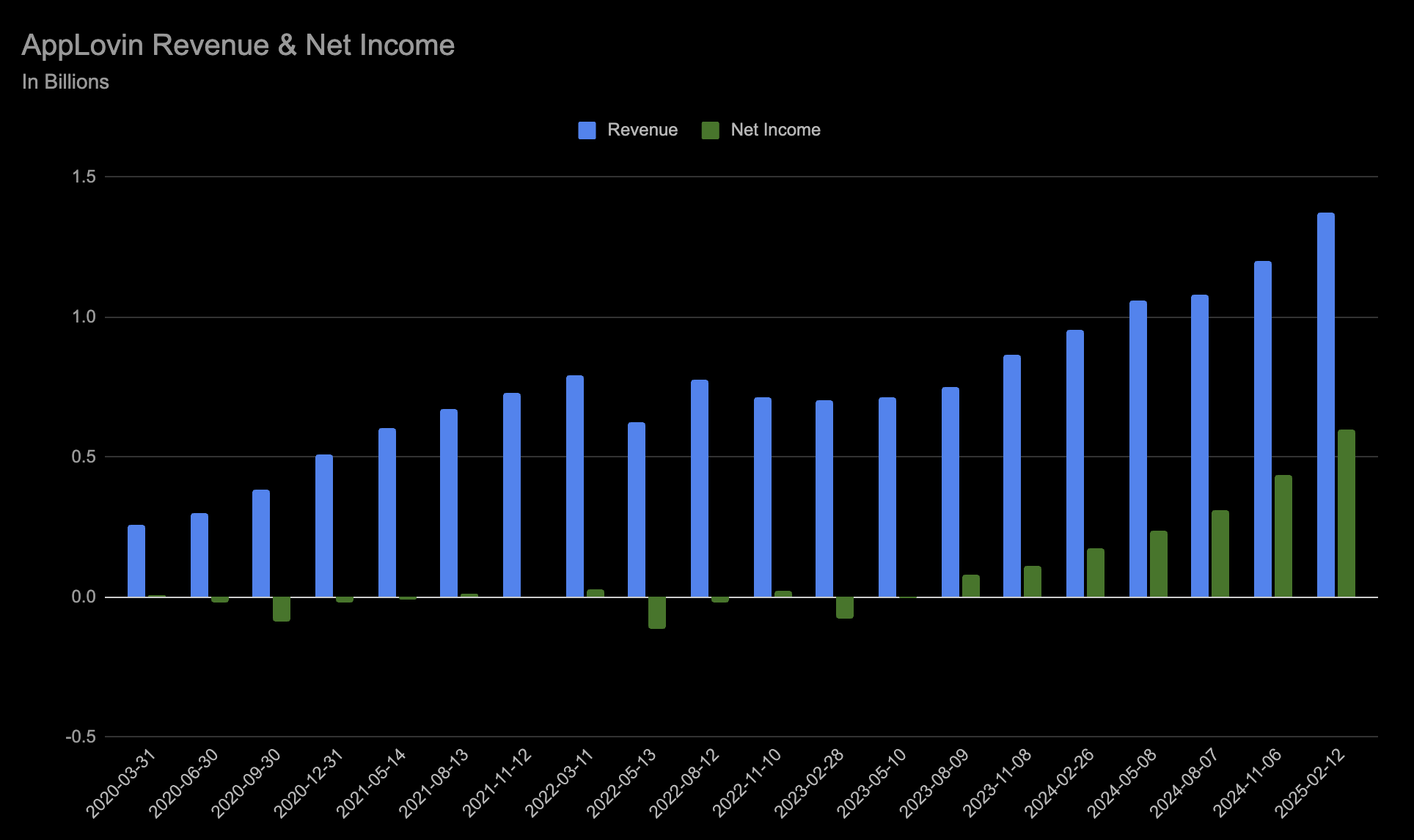

AppLovin delivered a surprise in its latest earnings report, exceeding market expectations and reinforcing its position in the mobile advertising and app monetization space. The company reported $1.37 billion in revenue for Q4 2024, a 44% year-over-year increase, driven by strong performance in its ad network business. Advertising revenue alone saw a 73% jump, reaching $999.5 million, while net income surged 248% to $599.2 million, far exceeding analyst expectations. Earnings per share (EPS) came in at $1.73, surpassing the projected $1.12, fueling investor confidence and sending the stock higher in after-hours trading.

This momentum adds to AppLovin’s broader market success. Over the past year, the company’s market capitalization has seen extraordinary growth, now standing at $173.46 billion, a substantial increase from its lower valuations in previous years. The stock has surged more than 750% year-over-year, reflecting strong investor sentiment around the company’s AI-driven advertising model and its ability to capture more digital ad spending. Expansion into e-commerce advertising has also contributed to new revenue streams, further strengthening its growth trajectory.

Despite the strong performance, AppLovin operates in a highly competitive and evolving market. The mobile advertising space is dynamic, with shifts in ad spending, regulatory considerations, and advancements in AI-driven ad placement all influencing future growth. Additionally, concerns around cost efficiency and ad transparency have been raised by some industry stakeholders, as AppLovin controls multiple aspects of the ad transaction process. While the company has demonstrated strong execution, maintaining its current growth pace may require continuous innovation and adaptation.

AppLovin’s latest earnings reaffirm its position as a key player in the mobile ad market. While challenges remain, its recent results showcase its ability to drive revenue and profitability through strategic initiatives. As the digital advertising landscape continues to evolve, AppLovin’s ability to sustain its momentum will be closely watched by investors and industry analysts alike.

About The Author

Sia Gholami

Sia Gholami is a distinguished expert in the intersection of

artificial intelligence and finance. He holds a bachelor's, master's, and Ph.D. in computer

science, with his doctoral thesis focused on efficient large language models and their

applications—an area crucial to the development of advanced AI systems. Specializing in machine

learning and artificial intelligence, Sia has authored several research papers published in

peer-reviewed venues, establishing his authority in both academic and professional circles.

Sia has created AI models and systems specifically designed to identify opportunities in the

public market, leveraging his expertise to develop cutting-edge financial technologies. His most

recent role was at Amazon, where he worked within Amazon Ads, developing and deploying AI and

machine learning models to production with remarkable success. This experience, combined with

his deep technical knowledge and understanding of financial systems, positions Sia as a leading

figure in AI-driven financial technologies. His extensive background has also led him to found

and lead successful ventures, driving innovation at the convergence of AI and finance.